Fundamentals

For a small to medium-sized business (SMB), understanding Financial Instability Metrics is like having a health check for your company’s financial well-being. Just as a doctor uses vital signs to assess a patient’s health, business owners and managers can use financial metrics to gauge the stability and sustainability of their operations. In essence, these metrics are tools that help you identify potential financial problems before they become critical, allowing for proactive intervention and strategic adjustments.

For an SMB, financial instability isn’t just about not having enough money; it’s about a broader set of indicators that suggest your business might be vulnerable to shocks, downturns, or even internal inefficiencies that could lead to financial distress. It’s about recognizing the early warning signs and taking corrective action to ensure long-term viability and growth.

Financial instability metrics are vital signs for SMB financial health, enabling early detection and proactive management of potential issues.

What are Financial Instability Metrics?

At its core, Financial Instability in an SMB context refers to a state where a business’s financial health Meaning ● Financial Health, within the SMB landscape, indicates the stability and sustainability of a company's financial resources, dictating its capacity for strategic growth and successful automation implementation. is precarious, making it susceptible to failure or significant disruption. This isn’t always immediately obvious by just looking at a bank balance. It’s often reflected in a combination of factors that, when analyzed together, paint a clearer picture of the company’s resilience. Financial Instability Metrics are the quantifiable measures used to assess this precariousness.

They are not just about current profitability but also about a business’s ability to meet its obligations, manage its debts, and withstand unexpected financial pressures. For an SMB, these pressures can range from a sudden drop in sales to an unexpected increase in supplier costs, or even broader economic downturns.

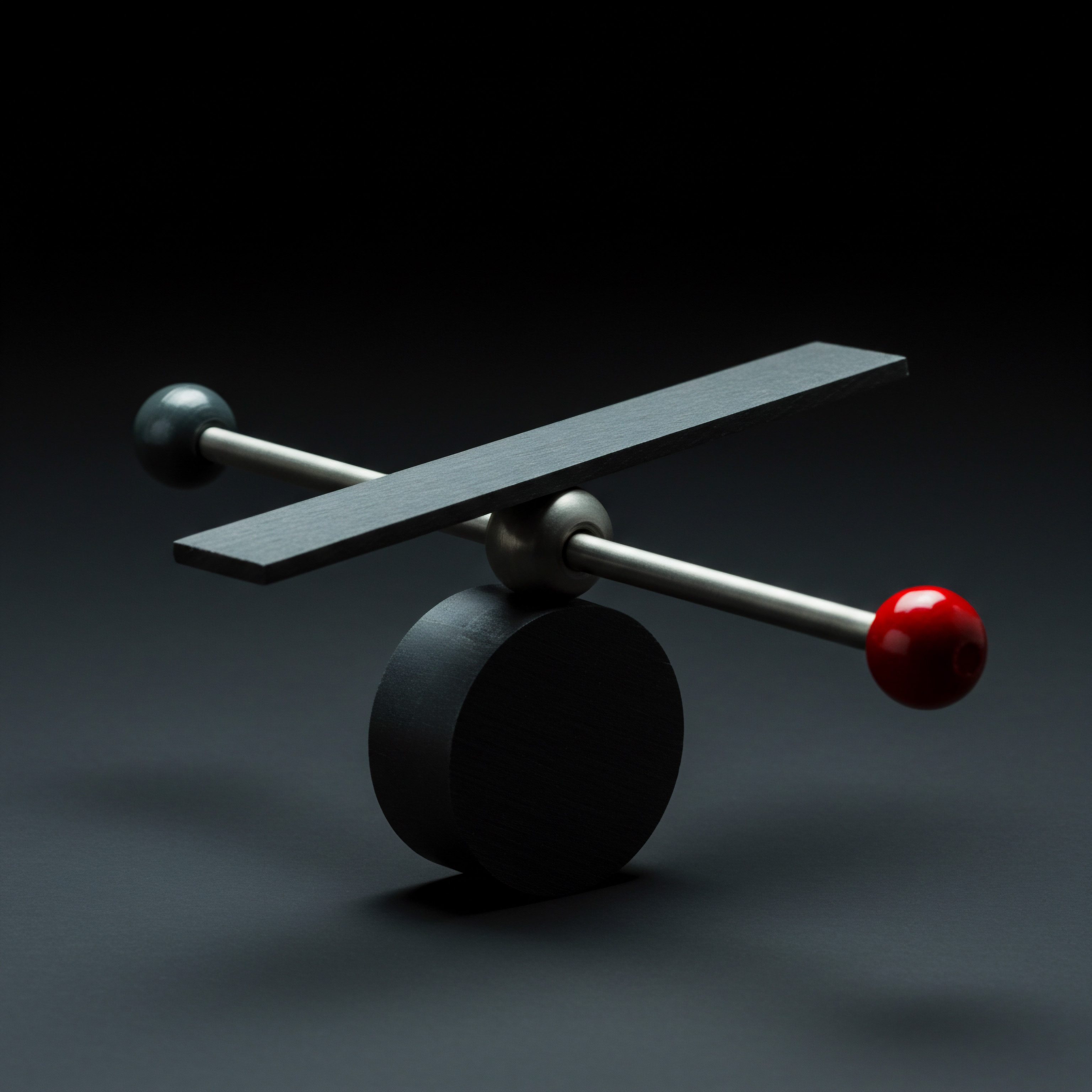

Think of these metrics as a dashboard in a car. Each gauge ● like fuel level, engine temperature, and speed ● provides crucial information about the car’s performance and condition. Similarly, financial instability metrics offer insights into different aspects of an SMB’s financial health. By regularly monitoring these metrics, business owners can understand if their financial engine is running smoothly, overheating, or running low on fuel.

This understanding is crucial for making informed decisions and steering the business away from potential financial hazards. Ignoring these metrics is akin to driving without looking at the dashboard ● you might be fine for a while, but you’re increasing the risk of a breakdown.

Key Fundamental Metrics for SMBs

For SMBs, focusing on a few key fundamental metrics is often more effective than getting lost in a sea of complex financial jargon. These fundamental metrics provide a solid foundation for understanding financial stability. Here are some of the most crucial ones:

Liquidity Ratios ● Can You Pay Your Bills?

Liquidity is the lifeblood of any SMB. It refers to the business’s ability to meet its short-term obligations ● bills, salaries, rent, and so on ● as they come due. Liquidity ratios measure this ability. If an SMB is illiquid, it means it might struggle to pay its immediate debts, even if it’s profitable in the long run.

This can lead to serious problems, including damaged supplier relationships, late payment penalties, and even legal action. For SMBs, maintaining healthy liquidity is paramount for day-to-day operations and for seizing growth opportunities that may require quick access to funds.

Two primary liquidity ratios are essential for SMBs to track:

- Current Ratio ● This is calculated as Current Assets divided by Current Liabilities. Current assets are those that can be converted into cash within a year (like cash, accounts receivable, and inventory), and current liabilities are debts due within a year (like accounts payable, short-term loans, and salaries payable). A current ratio of 1.5 to 2 is generally considered healthy for many SMBs, indicating they have sufficient liquid assets to cover their short-term liabilities. A ratio below 1 might signal potential liquidity issues. For example, if an SMB has current assets of $150,000 and current liabilities of $100,000, the current ratio is 1.5 ($150,000 / $100,000).

- Quick Ratio (Acid-Test Ratio) ● This is a more stringent measure of liquidity, calculated as (Current Assets – Inventory) divided by Current Liabilities. It’s similar to the current ratio but excludes inventory from current assets because inventory might not be easily or quickly converted into cash, especially for some SMBs. This is particularly relevant for SMBs holding large inventories or those in industries where inventory turnover is slow. A quick ratio of 1 or above is generally considered healthy, suggesting the SMB can meet its short-term liabilities even without relying on selling inventory. For instance, if the same SMB from the previous example has an inventory of $30,000, the quick ratio becomes ($150,000 – $30,000) / $100,000 = 1.2.

Regularly monitoring these ratios helps SMBs proactively manage their short-term financial health and avoid liquidity crises.

Solvency Ratios ● Can You Survive Long-Term Debt?

While liquidity focuses on short-term obligations, Solvency addresses the long-term financial health of an SMB. Solvency ratios assess a company’s ability to meet its long-term debt obligations and continue operating in the foreseeable future. For SMBs, taking on debt can be a necessary part of growth, but excessive debt or poor debt management can lead to financial instability and even bankruptcy. Solvency metrics help SMB owners understand their debt burden and whether their business is financially sound enough to handle it over the long haul.

A key solvency ratio for SMBs is:

- Debt-To-Equity Ratio ● This ratio compares a company’s total debt to its shareholders’ equity, calculated as Total Debt divided by Shareholders’ Equity. It indicates the extent to which a company is using debt to finance its assets versus equity. A higher ratio suggests a greater reliance on debt financing, which can increase financial risk. The acceptable level for this ratio varies by industry, but generally, a ratio below 1 is considered relatively conservative, while a ratio above 2 might raise concerns about excessive leverage. For example, if an SMB has total debt of $200,000 and shareholders’ equity of $400,000, the debt-to-equity ratio is 0.5 ($200,000 / $400,000). This suggests a healthy balance between debt and equity financing.

Monitoring the debt-to-equity ratio helps SMBs manage their capital structure and ensure they are not overleveraged, which is crucial for long-term financial stability.

Profitability Ratios ● Are You Making Money Effectively?

Profitability is the cornerstone of any sustainable business. Profitability ratios measure how effectively an SMB generates profit from its revenues or assets. While being profitable doesn’t guarantee financial stability on its own, consistent profitability is essential for long-term survival and growth.

For SMBs, profitability is not just about making sales; it’s about managing costs effectively and pricing products or services appropriately to ensure a healthy bottom line. Profitability metrics help SMB owners understand their earning power and identify areas where they can improve efficiency and increase profits.

Two important profitability ratios for SMBs are:

- Gross Profit Margin ● Calculated as (Gross Profit / Revenue) 100%. Gross profit is revenue minus the cost of goods sold (COGS). This ratio shows the percentage of revenue remaining after covering the direct costs of producing goods or services. A higher gross profit margin indicates that an SMB is efficiently managing its production costs and pricing its products or services effectively. Industry benchmarks vary, but generally, a higher gross profit margin is better. For instance, if an SMB has revenue of $500,000 and a cost of goods sold of $300,000, the gross profit is $200,000, and the gross profit margin is (200,000 / 500,000) 100% = 40%.

- Net Profit Margin ● Calculated as (Net Profit / Revenue) 100%. Net profit is the profit remaining after all operating expenses, interest, and taxes are deducted from revenue. This ratio represents the percentage of revenue that ultimately becomes profit for the business owner. The net profit margin provides a comprehensive view of overall profitability after considering all costs. Like gross profit margin, higher is generally better, but industry norms should be considered. If the same SMB has a net profit of $50,000, the net profit margin is (50,000 / 500,000) 100% = 10%.

Monitoring these profitability ratios helps SMBs assess their operational efficiency Meaning ● Maximizing SMB output with minimal, ethical input for sustainable growth and future readiness. and pricing strategies, driving sustainable profit generation.

Practical Application for SMBs ● Simple Steps to Monitor Financial Instability Metrics

For an SMB owner or manager who might not be a financial expert, the idea of tracking financial metrics can seem daunting. However, it doesn’t have to be complicated. Here are simple, practical steps SMBs can take to monitor these fundamental financial instability metrics:

- Regularly Review Financial Statements ● At a minimum, SMBs should review their income statements, balance sheets, and cash flow Meaning ● Cash Flow, in the realm of SMBs, represents the net movement of money both into and out of a business during a specific period. statements monthly. These statements are the raw data from which financial metrics are calculated. Automation tools and accounting software can significantly simplify this process.

- Actionable Step ● Set a recurring calendar reminder to review financial statements at the end of each month.

- Calculate Key Ratios ● Using the data from financial statements, calculate the current ratio, quick ratio, debt-to-equity ratio, gross profit margin, and net profit margin. Spreadsheets (like Excel or Google Sheets) are perfectly adequate for this purpose, especially for smaller SMBs.

- Actionable Step ● Create a simple spreadsheet template to automatically calculate these ratios once financial data is entered.

- Benchmark Against Industry Averages ● Understand what constitutes a healthy range for these ratios in your specific industry. Industry associations, online resources, and financial advisors can provide benchmark data. Comparing your SMB’s ratios to industry averages provides context and helps identify areas of strength or weakness.

- Actionable Step ● Research industry-specific benchmarks for these ratios and note them in your spreadsheet for easy comparison.

- Track Trends Over Time ● Don’t just look at metrics in isolation for a single month. Track how these ratios change over time ● month-to-month, quarter-to-quarter, and year-to-year. Trends can reveal emerging financial instability issues or highlight areas of improvement. For instance, a consistently declining current ratio might signal a growing liquidity problem.

- Actionable Step ● Graphically represent your key ratios over time to visually identify trends and patterns.

- Seek Professional Advice When Needed ● If you notice unfavorable trends or if the ratios are consistently outside of healthy ranges, don’t hesitate to seek advice from a financial advisor or accountant. They can provide expert insights and help develop strategies to address potential financial instability.

- Actionable Step ● Establish a relationship with a trusted financial advisor who understands SMBs and can provide guidance when needed.

By taking these simple yet consistent steps, SMBs can effectively monitor their financial health using fundamental instability metrics and take proactive measures to ensure long-term sustainability and growth.

In conclusion, for SMBs, financial instability metrics are not just abstract numbers; they are practical tools for understanding and managing financial health. By focusing on fundamental metrics like liquidity, solvency, and profitability ratios, and by implementing simple monitoring practices, SMB owners can navigate the complexities of business finance with greater confidence and resilience. This foundational understanding is the first step towards building a financially stable and thriving SMB.

As we move to the intermediate level, we will explore more sophisticated metrics and analytical techniques that can provide deeper insights into financial instability and strategic decision-making for SMB growth.

Intermediate

Building upon the foundational understanding of financial instability metrics, the intermediate level delves into more nuanced and strategic applications for SMBs. At this stage, we move beyond basic ratio calculations to explore metrics that provide deeper insights into operational efficiency, financial flexibility, and the underlying drivers of financial instability. For SMBs aiming for sustained growth and competitive advantage, understanding and utilizing these intermediate metrics becomes increasingly crucial. It’s about moving from simply monitoring financial health to proactively managing and optimizing financial performance to support strategic objectives.

Intermediate financial instability metrics empower SMBs to move from reactive monitoring to proactive financial management and strategic optimization.

Expanding the Metric Toolkit ● Beyond the Fundamentals

While fundamental metrics like liquidity, solvency, and profitability ratios are essential, they provide a somewhat static snapshot of financial health. Intermediate metrics offer a more dynamic perspective, focusing on the efficiency of operations and the flexibility of the financial structure. These metrics help SMBs identify bottlenecks, optimize resource allocation, and build resilience against financial shocks. Understanding these metrics allows SMBs to make more informed decisions about investments, operational improvements, and strategic initiatives.

Key Intermediate Metrics for SMBs

To enhance financial stability and drive growth, SMBs should incorporate these intermediate metrics into their financial monitoring and analysis:

Cash Conversion Cycle (CCC) ● How Efficiently is Your Cash Flowing?

The Cash Conversion Cycle (CCC) is a critical metric for SMBs, especially those dealing with inventory and accounts receivable. It measures the time (in days) it takes for a company to convert its investments in inventory and other resources into cash flows from sales. A shorter CCC implies greater efficiency in managing working capital, meaning the business ties up less cash in its operations.

For SMBs, efficient cash flow management is paramount for funding day-to-day operations, investments, and weathering economic uncertainties. A longer CCC can indicate inefficiencies that might lead to liquidity issues and increased financial vulnerability.

The CCC is calculated as follows:

CCC = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payables Outstanding (DPO)

- Days Inventory Outstanding (DIO) ● Measures the average number of days it takes to sell inventory. Calculated as (Average Inventory / Cost of Goods Sold) 365. A lower DIO is generally better, indicating efficient inventory management. For example, if an SMB has average inventory of $50,000 and COGS of $300,000, DIO = ($50,000 / $300,000) 365 ≈ 61 days.

- Days Sales Outstanding (DSO) ● Measures the average number of days it takes to collect payment after a sale. Calculated as (Average Accounts Receivable Meaning ● Accounts Receivable (AR) represents the outstanding payments owed to a Small or Medium-sized Business (SMB) by its customers for goods sold or services rendered on credit; effectively, it reflects the money the SMB expects to receive in the short term. / Revenue) 365. A lower DSO is desirable, indicating efficient credit and collection processes. If the same SMB has average accounts receivable of $40,000 and revenue of $500,000, DSO = ($40,000 / $500,000) 365 ≈ 29 days.

- Days Payables Outstanding (DPO) ● Measures the average number of days it takes to pay suppliers. Calculated as (Average Accounts Payable Meaning ● Accounts Payable (AP) represents a business's short-term liabilities to its creditors for goods or services received but not yet paid for. / Cost of Goods Sold) 365. A higher DPO can be beneficial as it allows the SMB to hold onto cash longer, but it should be balanced against maintaining good supplier relationships. If the SMB has average accounts payable of $30,000 and COGS of $300,000, DPO = ($30,000 / $300,000) 365 ≈ 37 days.

Using these values, the CCC for this SMB is 61 + 29 – 37 = 53 days. Analyzing and actively managing each component of the CCC can significantly improve an SMB’s cash flow and financial stability.

Operating Leverage ● How Sensitive Are Your Profits to Sales Changes?

Operating Leverage is a metric that measures the degree to which a company uses fixed costs in its operations. High operating leverage means a large proportion of costs are fixed (like rent, salaries, depreciation), while low operating leverage indicates a higher proportion of variable costs (like direct materials, sales commissions). Understanding operating leverage is crucial for SMBs because it directly impacts how changes in sales revenue affect profitability.

SMBs with high operating leverage experience larger swings in profits for a given change in sales compared to those with low operating leverage. This can amplify both profits during good times and losses during downturns, impacting financial stability.

Operating leverage can be quantified using the Degree of Operating Leverage (DOL), although precise calculation can be complex for SMBs without detailed cost accounting systems. However, a conceptual understanding is valuable. SMBs can assess their operating leverage by considering the proportion of fixed versus variable costs in their cost structure. For instance, a software-as-a-service (SaaS) SMB with high upfront development costs (fixed) and low variable costs per user typically has high operating leverage.

Conversely, a retail SMB with a high cost of goods sold (variable) and relatively lower fixed costs might have lower operating leverage. Understanding their operating leverage helps SMBs anticipate the impact of sales fluctuations on their bottom line and plan accordingly.

Financial Flexibility ● Can You Adapt to Financial Shocks?

Financial Flexibility is not a single ratio but rather a qualitative assessment of an SMB’s ability to respond to unexpected financial needs and opportunities. It encompasses various aspects of financial management that provide a buffer against financial instability. For SMBs, financial flexibility is crucial for navigating volatile markets, seizing growth opportunities, and weathering unforeseen challenges. It’s about having the financial resources and strategic options to adapt and thrive in a dynamic business environment.

Key indicators of financial flexibility for SMBs include:

- Available Cash and Credit Lines ● Having readily accessible cash reserves and unused credit lines provides a financial cushion to absorb unexpected expenses or revenue shortfalls. SMBs should aim to maintain a healthy cash balance and establish relationships with banks to secure credit lines that can be activated when needed.

- Debt Capacity ● This refers to the SMB’s ability to take on additional debt if necessary. A low debt-to-equity ratio (as discussed in fundamentals) and strong debt service coverage ratios (ability to cover debt payments with earnings) indicate higher debt capacity and thus greater financial flexibility.

- Asset Liquidity ● The ease and speed with which an SMB can convert its assets into cash. Having a mix of liquid assets (like cash and marketable securities) and less liquid but potentially valuable assets (like real estate or equipment) can provide flexibility. In times of financial stress, liquid assets can be readily used, while other assets can be strategically sold or leveraged if needed.

- Diversification of Revenue Streams ● SMBs that rely on a single product, service, or customer segment are more vulnerable to financial shocks. Diversifying revenue streams across different offerings, customer types, or geographic markets enhances financial stability and flexibility.

- Cost Structure Flexibility ● The ability to adjust costs in response to changes in revenue. SMBs with a higher proportion of variable costs have greater cost structure flexibility as costs can be reduced more readily when sales decline. Conversely, SMBs can scale up variable costs as sales increase.

Assessing and enhancing financial flexibility is an ongoing strategic effort for SMBs. It involves proactive financial planning, risk management, and strategic decision-making to build resilience and adaptability.

Automation and Implementation for Intermediate Metrics

Calculating and monitoring intermediate metrics can be more complex than fundamental ratios, but automation and smart implementation can make it manageable for SMBs. Leveraging technology and integrating these metrics into regular business processes is key.

Automation Tools and Software

Several tools and software solutions can streamline the calculation and tracking of intermediate financial instability metrics for SMBs:

- Accounting Software with Advanced Reporting ● Modern accounting software like QuickBooks Online, Xero, and Zoho Books offer features beyond basic bookkeeping. They often include modules for financial reporting, ratio analysis, and cash flow forecasting. These platforms can automatically calculate CCC, track cash balances, and generate reports on key metrics.

- Implementation Tip ● Explore the reporting and analytics features of your existing accounting software. Many SMBs underutilize these capabilities. Set up customized reports to automatically generate CCC, liquidity ratios, and profitability trends on a monthly or quarterly basis.

- Financial Planning and Analysis (FP&A) Software ● For SMBs with more complex financial needs, FP&A software like Jirav, Planful, or Vena Solutions can provide advanced capabilities for budgeting, forecasting, scenario planning, and performance analysis. These tools can help SMBs model the impact of operating leverage, assess financial flexibility under different scenarios, and develop more sophisticated financial strategies.

- Implementation Tip ● Consider FP&A software as your SMB grows and financial complexity increases. Start with a free trial or demo to assess if the features align with your needs and budget. Focus on tools that integrate with your existing accounting system to avoid data silos.

- Business Intelligence (BI) Dashboards ● BI tools like Tableau, Power BI, and Google Data Studio can visualize financial data and metrics in interactive dashboards. SMBs can create custom dashboards to track CCC, operating leverage indicators, and financial flexibility metrics alongside fundamental ratios. Visual dashboards make it easier to spot trends, identify outliers, and communicate financial performance across the organization.

- Implementation Tip ● Start with a simple BI dashboard focused on key intermediate metrics. Connect it to your accounting data and other relevant data sources (like sales data, inventory data). Regularly review the dashboard with your team to discuss insights and make data-driven decisions.

Integrating Metrics into Business Processes

To maximize the value of intermediate financial instability metrics, SMBs should integrate them into their regular business processes and decision-making workflows:

- Regular Financial Performance Reviews ● Schedule regular (e.g., monthly or quarterly) financial performance review meetings. Use these meetings to discuss trends in CCC, operating leverage indicators, and financial flexibility assessments, alongside fundamental ratios. Involve key stakeholders from different departments (sales, operations, procurement) to gain a holistic view.

- Process Integration ● Make it a standard agenda item in management meetings to review the financial metrics dashboard and discuss any significant changes or trends. Assign responsibility for follow-up actions based on the insights gained.

- Working Capital Management Initiatives ● Use CCC analysis to identify areas for improvement in working capital management. For example, if DSO is high, implement strategies to expedite collections. If DIO is high, optimize inventory management practices. If DPO is low compared to industry norms, explore opportunities to negotiate extended payment terms with suppliers (while maintaining good relationships).

- Process Integration ● Develop specific action plans to improve CCC components. Set targets for DSO, DIO, and DPO reduction. Track progress against these targets and hold departments accountable for improvements.

- Scenario Planning and Stress Testing ● Use financial flexibility metrics to conduct scenario planning Meaning ● Scenario Planning, for Small and Medium-sized Businesses (SMBs), involves formulating plausible alternative futures to inform strategic decision-making. and stress testing. Model the impact of potential financial shocks (e.g., sales downturn, interest rate increases, supply chain disruptions) on your SMB’s financial stability. Assess your ability to withstand these shocks based on your cash reserves, debt capacity, and cost structure flexibility.

- Process Integration ● Conduct annual or semi-annual scenario planning exercises. Use FP&A tools or spreadsheets to model different scenarios. Develop contingency plans to mitigate the impact of adverse scenarios and enhance financial resilience.

- Strategic Investment Decisions ● Incorporate operating leverage considerations into strategic investment decisions. For example, when considering investments in automation or technology, analyze the impact on fixed versus variable costs and the resulting change in operating leverage. Evaluate whether the potential increase in operating leverage aligns with your SMB’s risk appetite and growth strategy.

- Process Integration ● Include operating leverage analysis as part of the financial due diligence process for major investments. Assess the potential impact on profitability under different sales scenarios. Choose investments that optimize operating leverage in line with strategic goals.

By embracing automation and strategically integrating intermediate financial instability metrics into business processes, SMBs can move beyond basic financial monitoring to proactive financial management. This intermediate level of analysis empowers SMBs to optimize operations, enhance financial flexibility, and make more informed strategic decisions, setting the stage for sustained growth and resilience.

As we advance to the expert level, we will delve into more sophisticated concepts, including advanced metrics, behavioral finance perspectives, and cross-sectoral influences on financial instability, providing a comprehensive and nuanced understanding for expert-level business analysis.

Advanced

Financial Instability Metrics, at an advanced level, transcend simple ratio analysis and delve into a holistic, dynamic, and often behavioral understanding of an SMB’s financial vulnerabilities. Moving beyond the readily quantifiable, expert analysis requires embracing complexity, uncertainty, and the intricate interplay of internal and external factors that can precipitate financial distress. At this stage, Financial Instability Metrics are not merely diagnostic tools but become integral components of strategic foresight, risk management, and the pursuit of sustainable competitive advantage.

The expert perspective recognizes that financial instability is not solely a matter of numbers; it is deeply intertwined with organizational behavior, market dynamics, and even macroeconomic trends. For SMBs aiming for long-term resilience and market leadership, mastering this advanced understanding is paramount.

Advanced financial instability metrics are strategic foresight Meaning ● Strategic Foresight: Proactive future planning for SMB growth and resilience in a dynamic business world. tools, integrating behavioral, dynamic, and contextual analyses for proactive risk management Meaning ● Risk management, in the realm of small and medium-sized businesses (SMBs), constitutes a systematic approach to identifying, assessing, and mitigating potential threats to business objectives, growth, and operational stability. and sustainable competitive advantage Meaning ● SMB Competitive Advantage: Ecosystem-embedded, hyper-personalized value, sustained by strategic automation, ensuring resilience & impact. in SMBs.

Redefining Financial Instability Metrics ● An Expert Perspective

From an advanced business perspective, Financial Instability Metrics are more accurately conceptualized as a constellation of indicators, both quantitative and qualitative, that collectively signal a heightened risk of financial disruption or collapse within an SMB. This expert-level definition moves beyond traditional accounting ratios to incorporate:

- Dynamic Metrics ● Metrics that capture changes and trends over time, reflecting the evolving financial health of the SMB rather than static snapshots. This includes trend analysis of key ratios, volatility measures of cash flows, and leading indicators of financial stress.

- Behavioral Metrics ● Metrics that assess the impact of managerial decisions, organizational culture, and cognitive biases on financial stability. This encompasses indicators of risk appetite, decision-making quality under pressure, and the effectiveness of internal controls.

- Contextual Metrics ● Metrics that account for the external environment in which the SMB operates, including industry-specific risks, macroeconomic conditions, regulatory changes, and competitive pressures. This involves industry benchmarking, sensitivity analysis to external shocks, and scenario planning incorporating macroeconomic forecasts.

- Non-Financial Metrics ● Metrics that are not purely financial but have a significant impact on financial stability, such as customer satisfaction, employee engagement, innovation rate, and brand reputation. These metrics often serve as early warning signals of potential financial problems and contribute to long-term value creation.

This expanded definition recognizes that financial instability in SMBs is a multifaceted phenomenon influenced by a complex web of factors. Expert analysis requires integrating these diverse perspectives to gain a comprehensive and actionable understanding.

Advanced Metrics and Analytical Techniques for SMBs

To achieve an expert-level understanding of financial instability, SMBs can leverage advanced metrics and analytical techniques that go beyond the fundamental and intermediate levels:

Economic Value Added (EVA) ● Measuring True Profitability and Value Creation

Economic Value Added (EVA) is a sophisticated metric that measures a company’s true economic profit by considering the cost of capital. Unlike traditional accounting profits, EVA accounts for the opportunity cost of all capital employed by the business, including equity. A positive EVA indicates that the SMB is generating returns in excess of its cost of capital, creating value for its stakeholders.

A negative EVA, conversely, suggests value destruction. For SMBs, EVA provides a more rigorous measure of profitability and value creation than traditional metrics like net profit margin, especially when assessing investment decisions and strategic performance.

EVA is calculated as:

EVA = Net Operating Profit After Tax (NOPAT) – (Capital Employed Weighted Average Cost of Capital (WACC))

- Net Operating Profit After Tax (NOPAT) ● Represents the profit generated from core business operations, net of taxes, but before interest expense and financing income. It reflects the true operating profitability of the SMB.

- Capital Employed ● The total capital invested in the business, typically calculated as total assets minus current liabilities (or alternatively, shareholders’ equity plus long-term debt).

- Weighted Average Cost of Capital (WACC) ● The average rate of return a company is expected to pay to its investors (both debt and equity holders) to finance its assets. Calculating WACC accurately for SMBs can be challenging, especially for privately held businesses without publicly traded equity. However, approximations can be made using industry benchmarks and considering the SMB’s specific risk profile.

While calculating WACC and EVA might seem complex for some SMBs, the underlying concept is powerfully insightful. Focusing on generating EVA encourages SMBs to make investment decisions that not only increase accounting profits but also enhance shareholder value by exceeding the cost of capital. For example, an SMB might have a high net profit margin but still have a negative EVA if its return on capital is less than its WACC. EVA highlights this value destruction and prompts strategic adjustments.

Z-Score Models (Adapted for SMBs) ● Predicting Bankruptcy Risk

Z-Score Models are statistical models used to predict the probability of bankruptcy or financial distress. Originally developed for large corporations, Z-score models can be adapted and applied to SMBs to provide an early warning system for potential financial instability. These models typically combine several financial ratios into a single score that indicates the level of financial risk. While no model is foolproof, Z-score models can be valuable tools for SMB owners and lenders to assess and monitor bankruptcy risk.

A simplified Z-score model for SMBs might include ratios like:

- Working Capital to Total Assets ● Measures liquidity and short-term solvency.

- Retained Earnings to Total Assets ● Measures cumulative profitability and reinvestment.

- Earnings Before Interest and Taxes (EBIT) to Total Assets ● Measures operating profitability.

- Market Value of Equity to Total Liabilities (or Book Value of Equity for Private SMBs) ● Measures leverage and solvency.

- Sales to Total Assets ● Measures asset turnover efficiency.

The Z-score is calculated as a weighted sum of these ratios, with weights determined through statistical analysis (often regression). A lower Z-score generally indicates a higher probability of financial distress. While adapting and calibrating a Z-score model specifically for SMBs requires statistical expertise and data, the concept of using a composite score based on multiple financial ratios to assess bankruptcy risk is highly relevant for advanced financial analysis in SMBs. SMBs can use simpler versions of Z-score models by assigning equal weights to key ratios and tracking the trend of the composite score over time as an indicator of changing financial risk.

Behavioral Finance Metrics ● Understanding Decision-Making Biases

Behavioral Finance recognizes that financial decisions are not always rational and are influenced by psychological biases and emotional factors. In the context of SMBs, understanding and mitigating behavioral biases in financial decision-making is crucial for maintaining financial stability. Behavioral finance metrics are not traditional financial ratios but rather indicators of decision-making processes and organizational culture that can impact financial outcomes.

Key behavioral finance aspects relevant to SMB financial instability include:

- Overconfidence Bias ● SMB owners and managers may be overconfident in their abilities and business prospects, leading to excessive risk-taking and underestimation of potential threats. Metrics to monitor might include the degree of optimism in financial forecasts compared to actual outcomes, the frequency of “black swan” events surprising the business, and the level of diversification in investment decisions.

- Confirmation Bias ● The tendency to seek out and interpret information that confirms pre-existing beliefs, while ignoring contradictory evidence. This can lead to flawed investment decisions and inadequate risk assessment. Metrics could involve tracking the diversity of information sources used in decision-making, the frequency of dissenting opinions being considered, and the process for challenging assumptions.

- Loss Aversion ● The tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain. This can lead to risk-averse behavior when facing potential losses, even if taking calculated risks is necessary for growth. Metrics might include the SMB’s risk appetite score (assessed through surveys or managerial interviews), the proportion of investments with asymmetric payoff profiles (high upside, limited downside), and the frequency of missed opportunities due to risk aversion.

- Groupthink ● In closely-knit SMB teams, groupthink can lead to conformity and suppression of dissenting opinions, resulting in poor decision-making. Metrics to assess groupthink potential could include the level of dissent and debate in decision-making meetings, the presence of diverse perspectives in leadership teams, and the mechanisms for anonymous feedback and whistleblowing.

Quantifying behavioral biases is challenging, but SMBs can develop qualitative assessments and proxy metrics to monitor these aspects. For example, regular “pre-mortem” exercises (imagining a project has failed and identifying potential reasons) can help counteract overconfidence and confirmation bias. Promoting a culture of open debate and constructive criticism can mitigate groupthink. Incorporating behavioral finance insights into financial decision-making enhances the robustness of risk management and strategic planning in SMBs.

Non-Financial Metrics as Leading Indicators

Non-Financial Metrics, while not directly reflected in financial statements, can serve as powerful leading indicators of future financial instability in SMBs. These metrics provide early warnings about potential problems that may eventually manifest in financial distress. Ignoring non-financial indicators can lead to delayed responses and more severe financial consequences.

Key non-financial metrics for SMBs to monitor include:

- Customer Satisfaction and Retention ● Declining customer satisfaction Meaning ● Customer Satisfaction: Ensuring customer delight by consistently meeting and exceeding expectations, fostering loyalty and advocacy. scores, increasing customer churn rates, and negative customer reviews are early signs of potential revenue decline and financial stress. Metrics to track include Net Promoter Score (NPS), customer retention rate, customer lifetime value, and social media sentiment analysis.

- Employee Engagement and Turnover ● Low employee engagement, high employee turnover, and negative employee feedback can indicate operational inefficiencies, declining productivity, and potential talent drain, all of which can negatively impact financial performance. Metrics include employee engagement Meaning ● Employee Engagement in SMBs is the strategic commitment of employees' energies towards business goals, fostering growth and competitive advantage. scores (from surveys), employee turnover rate, absenteeism rate, and Glassdoor ratings.

- Operational Efficiency Metrics ● Metrics related to production efficiency, quality control, supply chain performance, and innovation rate can highlight operational weaknesses that may lead to cost overruns, quality issues, and competitive disadvantages, eventually impacting financial stability. Examples include defect rates, on-time delivery rates, inventory turnover (as a non-financial measure of operational efficiency), and new product development cycle time.

- Market Share and Competitive Positioning ● Declining market share, increased competitive intensity, and erosion of competitive advantages are leading indicators of potential revenue pressure and financial vulnerability. Metrics include market share trends, competitor analysis reports, customer acquisition cost, and brand awareness scores.

- Regulatory Compliance and Legal Issues ● Non-compliance with regulations, legal disputes, and ethical lapses can result in fines, penalties, reputational damage, and legal liabilities, all of which can destabilize an SMB’s finances. Metrics include compliance audit results, number of regulatory violations, legal expense trends, and ethical conduct incident reports.

Integrating non-financial metrics into the overall financial instability monitoring framework provides a more holistic and forward-looking perspective. SMBs should establish systems to collect, track, and analyze these non-financial indicators alongside traditional financial metrics to gain a comprehensive view of their overall health and proactively address potential risks.

Cross-Sectoral Business Influences and Multi-Cultural Aspects

Financial instability in SMBs is not isolated within individual businesses or even specific sectors. Cross-sectoral business influences and multi-cultural aspects can significantly impact financial stability, particularly in today’s interconnected global economy. Expert analysis must consider these broader influences.

Cross-Sectoral Influences

SMBs are increasingly affected by trends and disruptions in sectors beyond their immediate industry. Understanding these cross-sectoral influences is crucial for anticipating and mitigating financial instability risks.

- Technology Sector Disruptions ● Rapid technological advancements in areas like artificial intelligence, cloud computing, and automation can disrupt traditional business models across sectors. SMBs that fail to adapt to technological changes may face obsolescence and financial decline. For example, the rise of e-commerce has fundamentally altered the retail sector, impacting SMBs in brick-and-mortar retail.

- Supply Chain Sector Volatility ● Global supply chain disruptions, as highlighted by recent events, can have cascading effects across sectors. SMBs reliant on complex global supply chains are vulnerable to disruptions in material sourcing, production, and distribution, leading to cost increases, revenue losses, and financial instability.

- Financial Sector Instability ● Macroeconomic factors and financial market volatility can directly impact SMBs’ access to capital, borrowing costs, and customer demand. Financial crises, interest rate hikes, and currency fluctuations can create significant financial instability risks for SMBs.

- Regulatory and Policy Sector Changes ● Changes in government regulations, trade policies, and labor laws can create both opportunities and challenges for SMBs across sectors. New environmental regulations, for example, may require SMBs to invest in compliance measures, impacting their financial performance.

- Consumer Behavior Shifts ● Changes in consumer preferences, demographics, and lifestyle trends can reshape demand patterns across sectors. SMBs must adapt to evolving consumer expectations to maintain market relevance and financial stability. For instance, the growing consumer focus on sustainability is driving demand for eco-friendly products and services, impacting SMBs across various sectors.

SMBs should conduct cross-sectoral scanning to identify potential threats and opportunities arising from trends in related and even seemingly unrelated sectors. Scenario planning should incorporate cross-sectoral disruptions to assess and mitigate potential financial instability risks.

Multi-Cultural Business Aspects

For SMBs operating in diverse markets or with international operations, multi-cultural aspects can significantly influence financial stability. Understanding cultural nuances in business practices, communication styles, and risk tolerance is essential.

- Communication and Trust ● Cultural differences in communication styles can impact negotiations, contract terms, and business relationships, potentially leading to misunderstandings and financial disputes. Building trust across cultures requires cultural sensitivity and effective cross-cultural communication strategies.

- Payment Practices and Credit Culture ● Payment practices and credit culture vary significantly across cultures. In some cultures, extended payment terms are common, while in others, prompt payment is expected. SMBs operating internationally need to adapt their credit policies and collection practices to local cultural norms.

- Risk Tolerance and Investment Decisions ● Risk tolerance and investment preferences can be culturally influenced. SMB owners from different cultural backgrounds may have varying attitudes towards debt, leverage, and financial risk-taking, impacting their financial strategies and stability.

- Ethical and Legal Norms ● Ethical and legal norms in business vary across cultures. SMBs operating internationally must navigate diverse ethical standards and legal frameworks to ensure compliance and avoid reputational damage and financial penalties.

- Talent Management and Workforce Diversity ● Managing a multi-cultural workforce requires understanding diverse cultural values, communication styles, and work ethics. Effective cross-cultural talent management is crucial for building a productive and engaged workforce, which indirectly contributes to financial stability.

SMBs engaged in international business should invest in cross-cultural training for their management teams and employees. Cultural due diligence should be part of market entry and international expansion strategies. Adapting financial practices and communication styles to local cultural contexts enhances business relationships and reduces the risk of financial instability arising from cultural misunderstandings.

Controversial Insight ● Embracing “Good Debt” for Strategic Instability

A potentially controversial yet expert-level insight is the strategic use of “good debt” to intentionally create a degree of “strategic instability” for SMB growth. While financial instability is generally viewed as negative, a calculated and controlled level of debt can be a catalyst for innovation, efficiency, and market disruption. This perspective challenges the conventional wisdom of minimizing debt at all costs and suggests that, under certain conditions, strategically leveraging debt can enhance long-term financial resilience and competitive advantage.

The concept of “good debt” in this context refers to debt that is used to finance investments with high growth potential and strong returns, such as:

- Investments in Automation and Technology ● Debt financing to automate processes, implement new technologies, and enhance operational efficiency can significantly improve productivity and profitability, generating returns that exceed the cost of debt.

- Strategic Acquisitions ● Debt-funded acquisitions of complementary businesses or technologies can accelerate growth, expand market share, and create synergies, leading to higher long-term profitability and market dominance.

- Expansion into New Markets ● Debt financing to fund geographic expansion or entry into new product/service categories can unlock significant growth opportunities and diversify revenue streams, reducing reliance on existing markets.

- Research and Development (R&D) Investments ● Debt financing to fund R&D activities and innovation initiatives can lead to the development of new products, services, and competitive advantages, driving future revenue growth and market leadership.

The “strategic instability” arises from the increased financial leverage and the pressure to generate high returns to service the debt. This pressure can force SMBs to become more efficient, innovative, and market-focused. It can create a sense of urgency and discipline that drives performance improvements and strategic agility. However, this approach is inherently risky and requires careful planning, rigorous financial analysis, and strong risk management capabilities.

Conditions for successfully embracing “good debt” for strategic instability:

- Clear Growth Strategy Meaning ● A Growth Strategy, within the realm of SMB operations, constitutes a deliberate plan to expand the business, increase revenue, and gain market share. and High ROI Projects ● The debt must be tied to specific investments with a well-defined growth strategy and a high probability of generating returns significantly exceeding the cost of debt.

- Strong Cash Flow Generation ● The SMB must have a proven track record of strong and predictable cash flow generation to ensure debt serviceability, even under moderately adverse conditions.

- Robust Financial Planning Meaning ● Financial planning for SMBs is strategically managing finances to achieve business goals, ensuring stability and growth. and Risk Management ● Detailed financial projections, sensitivity analysis, and contingency plans are essential to manage the increased financial risk associated with higher leverage.

- Disciplined Execution and Performance Monitoring ● Rigorous project management, performance tracking, and timely corrective actions are crucial to ensure that the debt-funded investments deliver the expected returns and contribute to long-term financial stability.

- Adaptive Organizational Culture ● The SMB culture must be adaptable, agile, and performance-oriented to thrive under the pressure of higher leverage and strategic instability.

This controversial perspective suggests that financial instability, when strategically and deliberately embraced through “good debt,” can be a powerful catalyst for SMB growth Meaning ● SMB Growth is the strategic expansion of small to medium businesses focusing on sustainable value, ethical practices, and advanced automation for long-term success. and market disruption. However, it is not a strategy for the faint-hearted or financially unprepared. It requires expert-level financial acumen, strategic foresight, and robust risk management capabilities.

Conclusion ● Expert-Level Financial Stability for SMB Resilience

At the advanced level, financial instability metrics become strategic tools for SMBs to navigate complexity, uncertainty, and disruption. By expanding the metric toolkit beyond traditional ratios to include dynamic, behavioral, contextual, and non-financial indicators, SMBs can gain a more holistic and forward-looking understanding of their financial vulnerabilities and opportunities. Embracing advanced analytical techniques like EVA, adapted Z-score models, and behavioral finance insights enhances risk assessment and strategic decision-making. Considering cross-sectoral influences and multi-cultural aspects is crucial for SMBs operating in today’s interconnected global economy.

The controversial concept of strategically embracing “good debt” to create “strategic instability” highlights the potential for calculated financial risk-taking to drive innovation, efficiency, and market disruption. However, this approach requires expert-level financial management and is not suitable for all SMBs. Ultimately, expert-level financial stability for SMBs is not about eliminating all financial risk but about understanding, managing, and strategically leveraging financial dynamics to build resilience, achieve sustainable growth, and create long-term value in an increasingly complex and volatile business environment. This advanced perspective empowers SMBs to move from simply reacting to financial instability to proactively shaping their financial destiny and achieving market leadership.