Fundamentals

For Small to Medium-sized Businesses (SMBs), the concept of Environmental, Social, and Governance (ESG) might initially seem like a complex and resource-intensive undertaking, often associated with large corporations. However, at its core, ESG is about operating responsibly and sustainably, considering the impact of your business on the environment, society, and how you govern yourselves. Think of it as a framework for making better business decisions that benefit not just your bottom line, but also the world around you. For an SMB, this could be as simple as reducing waste, ensuring fair labor practices, or having transparent business operations.

Automation, in the context of ESG implementation, simply means using technology to streamline and simplify the processes involved in managing and reporting on your ESG efforts. Instead of manually collecting data, filling out spreadsheets, and generating reports, automation tools Meaning ● Automation Tools, within the sphere of SMB growth, represent software solutions and digital instruments designed to streamline and automate repetitive business tasks, minimizing manual intervention. can handle much of this work. Imagine software that automatically tracks your energy consumption, monitors employee satisfaction through surveys, or compiles data for ESG reports. This not only saves time and resources but also reduces the risk of human error and ensures consistency in your ESG management.

Implementation refers to putting these ESG principles and automated tools into practice within your SMB. It’s about taking concrete steps to integrate ESG considerations into your daily operations, from procurement and production to marketing and customer service. For an SMB, implementation might start with identifying the most relevant ESG factors for your industry and business model, setting realistic goals, and gradually introducing automated systems to support your efforts. It’s a journey, not a destination, and even small steps can make a significant difference.

Why is Automated ESG Implementation Relevant for SMBs?

SMBs often operate with limited resources and tighter budgets compared to larger enterprises. This is precisely where the power of automation in ESG becomes particularly compelling. Manual ESG processes can be incredibly time-consuming and expensive, potentially putting ESG initiatives out of reach for many SMBs. Automation offers a pathway to make ESG accessible and manageable, allowing SMBs to participate in the growing global movement towards sustainable and responsible business practices.

Consider these key benefits for SMBs:

- Reduced Costs ● Automation minimizes the need for manual data collection and reporting, significantly reducing labor costs associated with ESG management. This allows SMBs to allocate resources more efficiently to other critical business functions.

- Improved Efficiency ● Automated systems streamline ESG processes, freeing up valuable time for SMB owners and employees to focus on core business activities. This increased efficiency can lead to higher productivity and faster growth.

- Enhanced Accuracy ● Automation reduces the risk of human error in data collection and reporting, ensuring more accurate and reliable ESG data. This is crucial for building trust with stakeholders and making informed business decisions.

- Better Reporting and Transparency ● Automated tools can generate standardized and comprehensive ESG reports, making it easier for SMBs to communicate their ESG performance to stakeholders, including customers, investors, and regulators. This transparency can enhance reputation and attract socially conscious customers and investors.

- Competitive Advantage ● In an increasingly ESG-conscious market, demonstrating a commitment to sustainability can provide SMBs with a competitive edge. Automated ESG implementation allows SMBs to effectively showcase their ESG efforts and attract customers and partners who value responsible business practices.

In essence, Automated ESG Implementation empowers SMBs to embrace sustainability without being overwhelmed by complexity or excessive costs. It levels the playing field, allowing even the smallest businesses to contribute to a more sustainable future while simultaneously strengthening their own business operations and market position.

Initial Steps for SMBs in Automated ESG Implementation

For SMBs just starting their ESG journey, the prospect of automation might seem daunting. However, the process can be broken down into manageable steps:

- Understand Your Business and Stakeholders ● Identify the most relevant ESG factors for your industry, business model, and stakeholders (customers, employees, suppliers, community). What are the key environmental and social impacts of your operations? What ESG issues are most important to your stakeholders?

- Set Realistic ESG Goals ● Start small and set achievable ESG goals that align with your business priorities and resources. Focus on a few key areas where you can make the most significant impact. For example, you might start by aiming to reduce energy consumption or improve waste management.

- Explore Automation Tools ● Research available ESG automation tools that are suitable for SMBs. Look for solutions that are affordable, user-friendly, and scalable to your business needs. Consider starting with basic tools and gradually expanding as your ESG program matures.

- Pilot and Iterate ● Begin with a pilot project to test and implement an automated ESG tool in a specific area of your business. Gather feedback, learn from the experience, and iterate to refine your approach. Don’t try to implement everything at once. Gradual implementation is key for SMBs.

- Communicate Your Progress ● Be transparent about your ESG efforts and communicate your progress to stakeholders. Share your goals, initiatives, and achievements. Even small steps are worth celebrating and can inspire others.

By taking these initial steps, SMBs can begin to integrate automated ESG implementation into their operations, paving the way for a more sustainable and successful future. Remember, the journey of a thousand miles begins with a single step, and for SMBs, that first step into automated ESG can be transformative.

Automated ESG implementation, at its core, is about making responsible and sustainable business practices accessible and manageable for SMBs through technology.

Intermediate

Building upon the fundamental understanding of Automated ESG Implementation, we now delve into the intermediate aspects, focusing on strategic considerations and practical applications for SMBs seeking to deepen their ESG integration. At this stage, SMBs are likely aware of the basic principles of ESG and the potential benefits of automation, and are now looking to move beyond introductory steps towards a more comprehensive and impactful approach.

Strategic Alignment of Automated ESG with SMB Growth Objectives

For SMBs, ESG should not be viewed as a separate, add-on initiative, but rather as an integral part of their overall business strategy. Effective Automated ESG Implementation requires aligning ESG goals with core business objectives, ensuring that sustainability efforts contribute directly to SMB growth Meaning ● SMB Growth is the strategic expansion of small to medium businesses focusing on sustainable value, ethical practices, and advanced automation for long-term success. and long-term value creation. This strategic alignment Meaning ● Strategic Alignment for SMBs: Dynamically adapting strategies & operations for sustained growth in complex environments. is crucial for securing buy-in from all stakeholders and maximizing the return on investment in ESG initiatives.

Consider these strategic alignment points:

- Customer Acquisition and Retention ● Increasingly, customers, especially younger generations, are prioritizing businesses that demonstrate a commitment to ESG. Automated ESG implementation can help SMBs effectively communicate their sustainability efforts, attracting and retaining customers who value responsible business practices. This can translate directly into increased sales and market share.

- Talent Attraction and Employee Engagement ● Employees, particularly millennials and Gen Z, are also seeking employers who are committed to ESG. A strong ESG profile, facilitated by automated implementation, can enhance an SMB’s employer brand, making it more attractive to top talent and boosting employee morale and engagement. This can lead to lower employee turnover and higher productivity.

- Investor Relations and Access to Capital ● While SMBs may not be directly targeted by large institutional ESG investors, demonstrating a commitment to ESG can improve their attractiveness to a wider range of investors, including impact investors and socially responsible investment funds. Automated ESG reporting provides the data transparency needed to build investor confidence and potentially access more favorable financing terms.

- Supply Chain Resilience and Risk Management ● ESG considerations are increasingly important in supply chain management. Automated ESG tools can help SMBs monitor and assess the ESG performance of their suppliers, identifying potential risks related to environmental impact, labor practices, and ethical sourcing. This can enhance supply chain resilience Meaning ● Supply Chain Resilience for SMBs: Building adaptive capabilities to withstand disruptions and ensure business continuity. and mitigate reputational and operational risks.

- Innovation and Operational Efficiency ● ESG initiatives often drive innovation and operational efficiency. For example, efforts to reduce energy consumption or waste generation, often facilitated by automation, can lead to cost savings and improved resource utilization. This can enhance profitability and competitiveness in the long run.

By strategically aligning Automated ESG Implementation with these growth objectives, SMBs can transform ESG from a compliance exercise into a powerful driver of business success. It becomes a source of competitive advantage, attracting customers, talent, and investors, while simultaneously enhancing operational efficiency Meaning ● Maximizing SMB output with minimal, ethical input for sustainable growth and future readiness. and mitigating risks.

Selecting and Implementing Intermediate-Level Automation Tools

As SMBs progress in their ESG journey, they may need to move beyond basic automation tools and explore more sophisticated solutions that offer greater functionality and deeper insights. Selecting the right tools is crucial for effective intermediate-level Automated ESG Implementation. This requires a careful assessment of business needs, budget constraints, and the specific ESG areas that are most relevant to the SMB.

Consider these factors when selecting intermediate-level automation tools:

- Scalability and Integration ● Choose tools that can scale with your SMB’s growth and integrate seamlessly with existing business systems, such as accounting software, CRM systems, and operational platforms. Integration is key to avoiding data silos and ensuring a holistic view of ESG performance.

- Customization and Reporting Capabilities ● Look for tools that offer customization options to tailor ESG metrics and reporting frameworks to your specific industry and business model. Robust reporting capabilities are essential for tracking progress, identifying areas for improvement, and communicating ESG performance to stakeholders effectively.

- Data Security and Privacy ● Ensure that the chosen tools have robust data security Meaning ● Data Security, in the context of SMB growth, automation, and implementation, represents the policies, practices, and technologies deployed to safeguard digital assets from unauthorized access, use, disclosure, disruption, modification, or destruction. and privacy measures in place to protect sensitive ESG data. Compliance with data privacy Meaning ● Data privacy for SMBs is the responsible handling of personal data to build trust and enable sustainable business growth. regulations, such as GDPR or CCPA, is crucial, especially when dealing with employee or customer data related to social and governance aspects of ESG.

- User-Friendliness and Training ● Select tools that are user-friendly and require minimal training for employees to adopt and utilize effectively. Complex and difficult-to-use tools can hinder adoption and reduce the ROI of automation investments. Prioritize tools with intuitive interfaces and readily available support and training resources.

- Cost-Effectiveness and ROI ● Conduct a thorough cost-benefit analysis to assess the ROI of different automation tools. Consider not only the upfront costs but also the ongoing maintenance and subscription fees. Choose tools that offer the best value for money and align with your SMB’s budget constraints.

Once the appropriate tools are selected, the implementation process should be carefully planned and executed. This may involve data migration, system integration, employee training, and ongoing monitoring and optimization. A phased implementation approach, starting with pilot projects and gradually expanding to other areas of the business, can help mitigate risks and ensure a smooth transition.

Data-Driven ESG Management and Performance Measurement

Intermediate-level Automated ESG Implementation emphasizes data-driven decision-making and performance measurement. Automation tools provide SMBs with access to real-time ESG data, enabling them to track progress against goals, identify trends, and make informed decisions to improve their ESG performance. This data-driven approach is essential for demonstrating accountability and continuous improvement Meaning ● Ongoing, incremental improvements focused on agility and value for SMB success. in ESG.

Key aspects of data-driven ESG management include:

- Setting Key Performance Indicators (KPIs) ● Define specific, measurable, achievable, relevant, and time-bound (SMART) KPIs for each relevant ESG area. For example, KPIs could include carbon emissions reduction targets, employee satisfaction scores, supplier ESG ratings, or waste diversion rates. Automated tools can help track and monitor these KPIs in real-time.

- Benchmarking and Peer Comparison ● Utilize automation tools to benchmark your SMB’s ESG performance against industry peers and best-in-class companies. Benchmarking provides valuable insights into areas where your SMB is lagging behind and where there is potential for improvement. It also helps set realistic and ambitious ESG targets.

- Regular Reporting and Performance Reviews ● Establish regular reporting cycles to track ESG performance, analyze trends, and identify areas requiring attention. Automated reporting tools can generate customized reports for different stakeholders, providing transparency and accountability. Regular performance reviews should be conducted to assess progress, identify challenges, and adjust strategies as needed.

- Data Analysis and Insights Generation ● Go beyond simply tracking data and utilize data analytics capabilities within automation tools to generate actionable insights. Identify correlations between ESG performance and business outcomes, uncover root causes of ESG challenges, and develop data-driven solutions to improve performance. This can lead to more effective and impactful ESG initiatives.

- Continuous Improvement and Optimization ● Embrace a culture of continuous improvement in ESG. Use data and insights from automated systems to identify opportunities for optimization, refine ESG strategies, and drive ongoing progress. Regularly review and update ESG goals and KPIs to reflect evolving business priorities and stakeholder expectations.

By adopting a data-driven approach to ESG management, SMBs can move beyond reactive compliance towards proactive sustainability leadership. Automated ESG Implementation provides the data infrastructure and analytical capabilities needed to make informed decisions, track progress, and continuously improve ESG performance, ultimately contributing to both business success and positive societal impact.

Strategic alignment of automated ESG with SMB growth objectives transforms ESG from a compliance exercise into a powerful driver of business success.

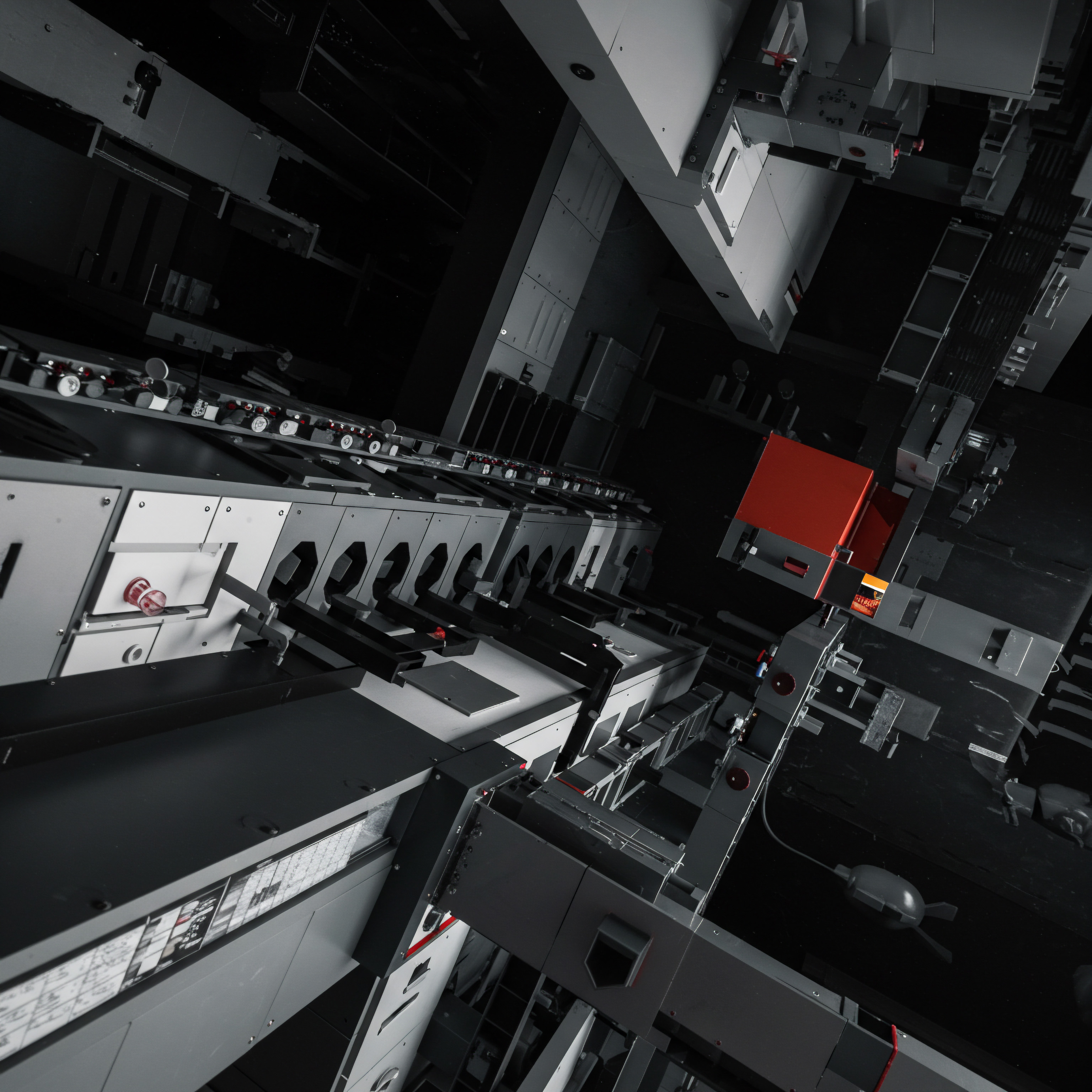

To illustrate the practical application of intermediate-level automated ESG implementation, consider the following table outlining potential tools and their applications for an SMB in the manufacturing sector:

| ESG Area Environmental (Energy Consumption) |

| Automation Tool Category Energy Management Systems (EMS) |

| Example Tool Schneider Electric EcoStruxure |

| SMB Application Automated monitoring of energy usage across manufacturing facilities, identification of energy waste areas. |

| Intermediate Level Benefit Real-time data for energy optimization, predictive maintenance to reduce energy-related downtime, automated reporting for energy audits and compliance. |

| ESG Area Social (Employee Engagement) |

| Automation Tool Category HR Management Systems (HRMS) with ESG Modules |

| Example Tool BambooHR with ESG Reporting Add-on |

| SMB Application Automated employee surveys on satisfaction and well-being, tracking diversity and inclusion metrics, managing employee volunteer programs. |

| Intermediate Level Benefit Data-driven insights into employee sentiment, automated tracking of diversity metrics for DEI reporting, streamlined management of social impact initiatives. |

| ESG Area Governance (Supply Chain Transparency) |

| Automation Tool Category Supply Chain Management (SCM) Platforms with ESG Features |

| Example Tool SAP Ariba with Sustainable Sourcing |

| SMB Application Automated supplier ESG questionnaires and assessments, tracking supplier certifications and compliance, mapping supply chain risks. |

| Intermediate Level Benefit Enhanced supply chain visibility for ESG risks, automated supplier performance monitoring, streamlined supplier engagement for ESG improvements. |

| ESG Area Reporting and Disclosure |

| Automation Tool Category ESG Reporting Software |

| Example Tool Diligent ESG |

| SMB Application Automated data collection from various sources, standardized ESG reporting frameworks (GRI, SASB), generation of ESG reports for stakeholders. |

| Intermediate Level Benefit Efficient and accurate ESG reporting, reduced manual reporting effort, improved transparency and credibility with stakeholders, streamlined compliance with reporting regulations. |

This table provides a glimpse into how intermediate-level automation tools can be applied across different ESG areas to provide tangible benefits for SMBs. By strategically selecting and implementing these tools, SMBs can significantly enhance their ESG performance and contribute to a more sustainable and responsible business ecosystem.

Advanced

The advanced definition of Automated ESG Implementation transcends simple operational efficiency and delves into a complex interplay of technological affordances, organizational behavior, and socio-economic imperatives. From an advanced perspective, Automated ESG Implementation represents the strategic deployment of digital technologies ● encompassing Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and blockchain ● to systematically integrate Environmental, Social, and Governance factors into the core business processes and decision-making frameworks of Small to Medium-sized Businesses (SMBs). This definition moves beyond mere automation of reporting to encompass a fundamental re-engineering of organizational structures and operational paradigms to proactively address ESG concerns.

Scholarly, we must dissect the multifaceted nature of this concept, acknowledging its diverse perspectives, cross-cultural business nuances, and cross-sectoral influences. The meaning is not monolithic but rather context-dependent, shaped by industry-specific ESG priorities, regional regulatory landscapes, and the unique organizational culture Meaning ● Organizational culture is the shared personality of an SMB, shaping behavior and impacting success. of each SMB. Furthermore, the ethical dimensions of automation in ESG cannot be overlooked. Concerns regarding algorithmic bias, data privacy, and the potential for ‘Greenwashing‘ through superficial automation necessitate a critical and nuanced advanced examination.

Deconstructing Automated ESG Implementation ● A Multi-Dimensional Framework

To fully grasp the advanced meaning of Automated ESG Implementation for SMBs, we must adopt a multi-dimensional framework that considers various intersecting perspectives:

1. Technological Perspective ● Affordances and Limitations

From a technological standpoint, Automated ESG Implementation leverages the affordances of digital technologies to enhance ESG management. AI and ML algorithms can analyze vast datasets to identify ESG risks and opportunities, predict environmental impacts, and optimize resource allocation. IoT sensors can provide real-time data on energy consumption, waste generation, and supply chain conditions, enabling proactive monitoring and intervention. Blockchain technology can enhance transparency and traceability in supply chains, particularly for ethical sourcing and carbon footprint tracking.

However, it is crucial to acknowledge the limitations of technology. Technological solutions are not panaceas. The effectiveness of Automated ESG Implementation depends heavily on data quality, algorithmic transparency, and the ethical considerations embedded in the design and deployment of these technologies.

Furthermore, the digital divide and the varying levels of technological maturity among SMBs pose significant challenges to widespread adoption. Advanced research must critically examine the technological determinism often associated with automation and emphasize the importance of human oversight and ethical governance in Automated ESG Implementation.

2. Organizational Behavior Perspective ● Culture, Adoption, and Resistance

Automated ESG Implementation is not merely a technological undertaking; it is fundamentally an organizational change management process. From an organizational behavior Meaning ● Organizational Behavior, particularly within SMB contexts, examines how individuals and groups act within an organization, and how these behaviors impact operational efficiency and strategic objectives, notably influencing growth, automation adoption, and successful implementation of new business systems. perspective, successful implementation requires fostering a culture of ESG consciousness, securing buy-in from all levels of the organization, and effectively managing potential resistance to change. SMBs often face unique organizational challenges, including limited managerial capacity, resource constraints, and a potentially less formalized organizational structure compared to larger corporations.

Advanced research in this area should focus on understanding the organizational dynamics that influence the adoption and diffusion of Automated ESG Implementation within SMBs. This includes exploring leadership styles, employee engagement strategies, training and capacity building programs, and the role of organizational culture in shaping ESG attitudes and behaviors. Furthermore, research should investigate the potential for automation to exacerbate existing organizational inequalities or create new forms of digital divide within SMBs.

3. Socio-Economic Perspective ● Value Creation, Stakeholder Engagement, and Impact Measurement

From a socio-economic perspective, Automated ESG Implementation must be evaluated based on its ability to create tangible value for SMBs and their stakeholders, while contributing to broader societal and environmental goals. This perspective emphasizes the importance of stakeholder engagement, impact measurement, and the alignment of ESG initiatives with sustainable development agendas. SMBs operate within complex socio-economic ecosystems, and their ESG performance can have significant ripple effects on local communities, supply chains, and the broader economy.

Advanced research in this domain should focus on developing robust methodologies for measuring the socio-economic impact of Automated ESG Implementation in SMBs. This includes exploring metrics beyond traditional financial indicators to encompass social and environmental outcomes, such as carbon footprint reduction, community development, and improved labor standards. Furthermore, research should investigate the role of Automated ESG Implementation in fostering inclusive and equitable economic growth, particularly in developing economies and marginalized communities. The concept of ‘Shared Value‘ creation, where ESG initiatives simultaneously benefit businesses and society, is central to this perspective.

4. Ethical and Governance Perspective ● Transparency, Accountability, and Algorithmic Bias

The ethical and governance dimensions of Automated ESG Implementation are paramount, particularly in light of increasing concerns about algorithmic bias, data privacy, and the potential for misuse of technology. From an ethical perspective, it is crucial to ensure that automated ESG systems are designed and deployed in a transparent, accountable, and equitable manner. This requires addressing potential biases in algorithms, protecting data privacy, and establishing robust governance frameworks to oversee the development and implementation of these technologies.

Advanced research in this area should critically examine the ethical implications of Automated ESG Implementation, particularly in the context of SMBs. This includes investigating potential biases in ESG data and algorithms, developing ethical guidelines for the use of AI in ESG, and exploring governance mechanisms to ensure accountability and transparency in automated ESG systems. The concept of ‘Responsible Innovation‘, which emphasizes the proactive consideration of ethical and societal implications throughout the innovation process, is highly relevant in this context.

Redefining Automated ESG Implementation for SMBs ● An Expert-Driven Synthesis

Synthesizing these multi-dimensional perspectives, we arrive at a refined advanced definition of Automated ESG Implementation for SMBs Meaning ● Integrating ESG into SMB operations for sustainable growth and long-term value. ●

Automated ESG Implementation for SMBs is the ethically governed, strategically aligned, and organizationally embedded deployment of digital technologies to proactively manage and enhance Environmental, Social, and Governance performance, driving sustainable value creation Meaning ● Sustainable Value Creation for SMBs: Building long-term business success by integrating environmental, social, and economic value, ensuring a positive impact on all stakeholders. for the SMB and its stakeholders, while contributing to broader socio-economic and environmental well-being.

This definition underscores several key elements:

- Ethical Governance ● Emphasizes the paramount importance of ethical considerations and robust governance frameworks in Automated ESG Implementation. This includes addressing algorithmic bias, data privacy, and ensuring transparency and accountability.

- Strategic Alignment ● Highlights the need to strategically align Automated ESG Implementation with core SMB business objectives, ensuring that ESG initiatives contribute directly to growth, competitiveness, and long-term value creation.

- Organizational Embedding ● Recognizes that successful implementation requires embedding ESG principles and automated systems into the organizational culture, processes, and decision-making frameworks of the SMB.

- Proactive Management and Enhancement ● Moves beyond reactive compliance to emphasize proactive management and continuous improvement of ESG performance through the use of automation technologies.

- Sustainable Value Creation ● Focuses on creating sustainable value for the SMB, encompassing not only financial returns but also social and environmental benefits for stakeholders.

- Socio-Economic and Environmental Well-Being ● Connects SMB ESG efforts to broader societal and environmental goals, recognizing the interconnectedness of business and the wider world.

This refined definition provides a more nuanced and comprehensive understanding of Automated ESG Implementation for SMBs, moving beyond simplistic notions of automation as merely a cost-saving or efficiency-enhancing tool. It positions Automated ESG Implementation as a strategic imperative for SMBs seeking to thrive in an increasingly ESG-conscious and interconnected global economy.

Controversial Insights and Future Directions for SMB Automated ESG Implementation

While the benefits of Automated ESG Implementation for SMBs are widely touted, a more critical and potentially controversial perspective acknowledges the inherent challenges and potential pitfalls. One such controversial insight is the risk of ‘ESG Washing‘ through superficial automation. SMBs, under pressure to demonstrate ESG credentials, may be tempted to adopt automated tools primarily for marketing purposes, without genuinely embedding ESG principles into their core operations. This can lead to a disconnect between reported ESG performance and actual impact, undermining the credibility of ESG initiatives and potentially harming stakeholder trust.

Another controversial area is the potential for automation to exacerbate existing inequalities within SMBs and their supply chains. The cost of implementing sophisticated automated ESG systems may be prohibitive for smaller SMBs, creating a competitive disadvantage compared to larger firms with greater resources. Furthermore, the focus on quantifiable ESG metrics, often facilitated by automation, may inadvertently overlook qualitative aspects of ESG, such as social justice and ethical considerations that are difficult to measure and automate. This can lead to a narrow and potentially biased view of ESG performance.

Future advanced research should address these controversial aspects and explore the following directions:

- Developing Robust Metrics and Frameworks for Measuring the Authenticity and Impact of Automated ESG Implementation in SMBs. This includes moving beyond superficial metrics and focusing on indicators that capture genuine ESG progress and stakeholder value creation.

- Investigating the Potential for ‘ESG Washing’ through Automation and Developing Strategies to Mitigate This Risk. This includes exploring transparency mechanisms, independent audits, and stakeholder engagement Meaning ● Stakeholder engagement is the continuous process of building relationships with interested parties to co-create value and ensure SMB success. strategies to ensure accountability and prevent greenwashing.

- Addressing the Digital Divide and Ensuring Equitable Access to Automated ESG Implementation Tools and Resources for All SMBs, Regardless of Size or Location. This may involve developing affordable and user-friendly automation solutions, providing training and capacity building programs, and fostering collaborative initiatives to support SMB ESG adoption.

- Exploring the Ethical Implications of AI and Automation in ESG, Particularly in Relation to Algorithmic Bias, Data Privacy, and the Potential for Job Displacement. This includes developing ethical guidelines for AI in ESG, promoting responsible innovation, and addressing the social and economic consequences of automation.

- Investigating the Role of Automated ESG Implementation in Fostering Circular Economy Meaning ● A regenerative economic model for SMBs, maximizing resource use and minimizing waste for sustainable growth. models and promoting resource efficiency within SMBs. This includes exploring the use of automation to optimize resource utilization, reduce waste generation, and facilitate the transition to a more sustainable and circular economy.

By critically examining these controversial insights and pursuing these future research directions, we can move towards a more nuanced and impactful understanding of Automated ESG Implementation for SMBs. This will enable SMBs to harness the power of automation to genuinely advance their ESG performance, contribute to a more sustainable future, and build resilient and responsible businesses for the long term.

Automated ESG implementation, when ethically governed and strategically aligned, becomes a powerful engine for sustainable value creation and positive societal impact for SMBs.

To further illustrate the advanced depth, consider this table analyzing the cross-sectoral influences on Automated ESG Implementation for SMBs, highlighting the diverse drivers and challenges across different industries:

| Sector Manufacturing |

| Key ESG Priorities Environmental impact (emissions, waste), supply chain ethics, worker safety. |

| Automation Opportunities IoT for energy monitoring, AI for predictive maintenance, blockchain for supply chain traceability. |

| Sector-Specific Challenges Legacy systems integration, high upfront investment, data security concerns in industrial environments. |

| Advanced Research Focus Impact of automation on manufacturing jobs, ethical implications of AI in worker monitoring, circular economy applications in manufacturing. |

| Sector Retail |

| Key ESG Priorities Sustainable sourcing, waste management (packaging), ethical labor practices in supply chains. |

| Automation Opportunities AI for demand forecasting to reduce waste, blockchain for product provenance, automated customer engagement for sustainability initiatives. |

| Sector-Specific Challenges Complex and fragmented supply chains, consumer behavior influence, balancing cost and sustainability in competitive markets. |

| Advanced Research Focus Consumer perception of automated ESG claims in retail, effectiveness of blockchain for supply chain transparency, impact of e-commerce on retail ESG. |

| Sector Services (e.g., IT, Consulting) |

| Key ESG Priorities Energy consumption of data centers, employee well-being, data privacy and security. |

| Automation Opportunities AI for data center energy optimization, HRMS with automated employee well-being surveys, cybersecurity automation for data protection. |

| Sector-Specific Challenges Measuring and reducing indirect environmental impacts, ensuring data privacy in service delivery, employee burnout and mental health in digital workplaces. |

| Advanced Research Focus Sustainability of digital infrastructure, ethical implications of AI in service delivery, impact of remote work on service sector ESG. |

| Sector Agriculture |

| Key ESG Priorities Sustainable land use, water management, biodiversity conservation, fair labor practices. |

| Automation Opportunities IoT for precision agriculture, AI for crop monitoring and yield optimization, blockchain for agricultural supply chain traceability. |

| Sector-Specific Challenges Data accessibility and infrastructure in rural areas, farmer adoption of technology, balancing productivity and environmental sustainability. |

| Advanced Research Focus Impact of technology on smallholder farmers, ethical considerations of AI in agriculture, role of automation in promoting sustainable food systems. |

This table demonstrates the sector-specific nuances of Automated ESG Implementation, highlighting the need for tailored approaches and industry-specific advanced research to address the unique challenges and opportunities in each sector. The future of Automated ESG Implementation for SMBs lies in embracing this complexity and developing context-aware solutions that are both technologically advanced and ethically grounded.