Unseen Influences How SMB Owners Make Financial Choices

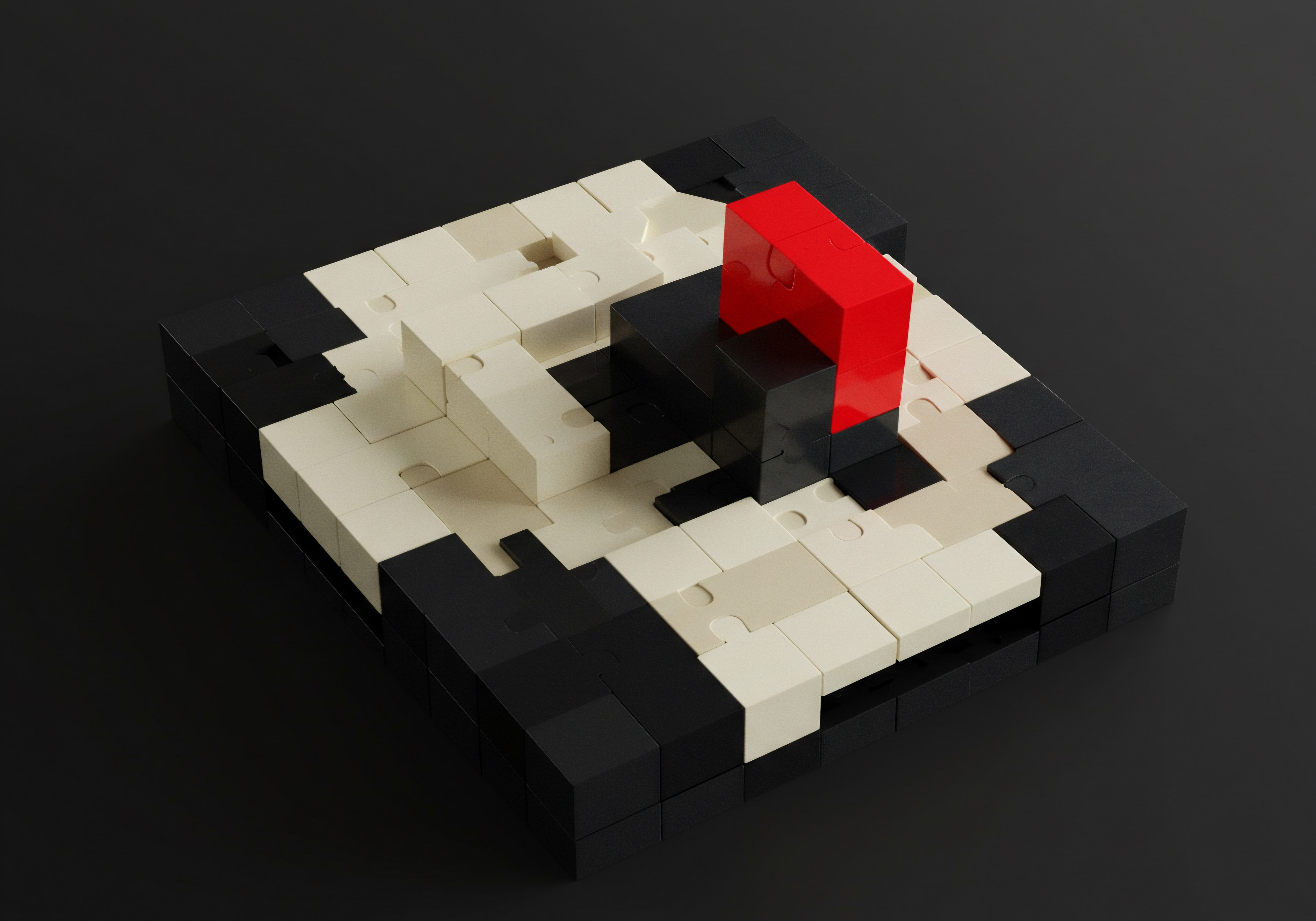

Small business owners, the backbone of any thriving economy, often navigate treacherous financial waters. They are lauded for their grit, their determination, and their capacity to bootstrap empires from shoestring budgets. Yet, behind the spreadsheets and projections, a less visible force subtly shapes their fiscal destinies ● behavioral biases. These are not flaws in character, but rather quirks in human cognition, systematic deviations from rational judgment that can lead even the most astute entrepreneurs astray.

Consider the local bakery owner, pouring personal savings into a new, untested product line simply because they are enamored with the idea, overlooking market research suggesting limited demand. This scenario, far from unique, highlights how deeply ingrained psychological patterns can skew financial decision-making within small and medium-sized businesses (SMBs).

The Optimism Trap And Its Fiscal Fallout

Optimism, often hailed as an entrepreneurial virtue, possesses a darker twin in the realm of behavioral economics ● optimism bias. This bias manifests as an unwarranted belief in exceptionally positive outcomes, coupled with a tendency to downplay potential risks. For SMB owners, particularly in the nascent stages of their ventures, this can translate into overly rosy financial forecasts. They might underestimate startup costs, overestimate projected revenues, or assume customer acquisition will be effortlessly swift.

This skewed perception of reality can lead to significant financial strain. Imagine a startup founder projecting first-year sales based solely on enthusiasm, neglecting to account for marketing expenses, customer acquisition costs, and the inevitable delays in product development. When reality inevitably falls short of these inflated expectations, the business can quickly find itself in a cash flow Meaning ● Cash Flow, in the realm of SMBs, represents the net movement of money both into and out of a business during a specific period. crisis, struggling to meet operational expenses and potentially jeopardizing its long-term viability.

Unrealistic financial projections, fueled by optimism bias, are a common precursor to cash flow problems in SMBs.

The consequences extend beyond mere budgetary shortfalls. Optimism bias can also influence investment decisions. SMB owners, convinced of their business’s inherent success, might overinvest in expansion projects or new equipment without conducting thorough due diligence. They might dismiss cautionary advice from financial advisors or ignore warning signs in market trends, blinded by their unwavering belief in a positive outcome.

This overconfidence can lead to misallocation of resources, tying up capital in ventures that yield subpar returns or, worse, result in outright losses. For instance, a restaurant owner, brimming with optimism about future growth, might take on a substantial loan to renovate their premises based on projected increased customer traffic, only to find that the anticipated surge fails to materialize. The debt burden then becomes a significant drag on the business, hindering its ability to adapt to changing market conditions or invest in other potentially more lucrative opportunities.

Anchoring Bias Sticking To Irrelevant Numbers

Humans possess a cognitive quirk known as anchoring bias, a tendency to heavily rely on the first piece of information encountered when making decisions, even if that information is demonstrably irrelevant. In the context of SMB finances, this bias can manifest in pricing strategies. Consider a retail store owner who initially prices a product based on a competitor’s price, even if their own cost structure or target market differs significantly. This initial “anchor” can unduly influence subsequent pricing decisions, potentially leading to suboptimal profit margins.

If the competitor’s price is artificially low due to a clearance sale or a different business model, the SMB owner risks underpricing their product, sacrificing potential revenue. Conversely, if the anchor price is too high, they might deter price-sensitive customers, losing out on sales volume.

Anchoring bias also permeates negotiations. When seeking funding from investors or negotiating terms with suppliers, SMB owners can be swayed by initial offers, even if those offers are not truly reflective of fair market value. For example, in a loan negotiation, the initial interest rate proposed by a lender can serve as an anchor, influencing the borrower’s perception of what constitutes a reasonable rate, even if they could potentially secure better terms elsewhere.

Similarly, when selling a business, the first valuation received, even if from an unqualified source, can become an anchor, preventing the owner from seeking a more accurate and potentially higher valuation. This reliance on initial anchors can result in SMBs accepting unfavorable deals, missing out on better opportunities, and ultimately diminishing their financial returns.

Confirmation Bias Seeking What You Already Believe

Confirmation bias, a pervasive cognitive tendency, describes our inclination to seek out, interpret, and remember information that confirms pre-existing beliefs, while simultaneously disregarding or downplaying contradictory evidence. For SMB owners, this bias can be particularly insidious in financial planning and analysis. Imagine a business owner who strongly believes in a particular marketing strategy.

They might selectively focus on positive customer feedback and anecdotal success stories related to that strategy, while ignoring negative data points, such as declining website traffic or low conversion rates. This selective attention to confirming evidence can lead to a distorted view of the strategy’s effectiveness, resulting in continued investment in a failing approach, diverting resources from potentially more fruitful alternatives.

Confirmation bias can blind SMB owners to critical financial data, leading to flawed strategic decisions.

This bias extends to financial risk assessment. An SMB owner who is inherently risk-averse might excessively focus on negative economic forecasts and worst-case scenarios, overlooking positive indicators and potential upside opportunities. This skewed risk perception can lead to overly conservative financial decisions, such as delaying necessary investments in growth initiatives or hoarding cash reserves unnecessarily, hindering the business’s potential for expansion and profitability. Conversely, a risk-seeking owner might selectively emphasize optimistic market projections and success stories of high-growth ventures, while dismissing cautionary signals and potential downsides.

This biased assessment can lead to imprudent financial risks, such as overleveraging the business or investing in speculative ventures with low probabilities of success. In both cases, confirmation bias distorts the owner’s perception of financial reality, leading to suboptimal decisions that can negatively impact the SMB’s financial health.

Overconfidence Bias Believing You Know More Than You Do

Overconfidence bias, a common human trait, manifests as an inflated sense of one’s own abilities and knowledge, particularly in predicting future outcomes. In the SMB landscape, this bias can be especially pronounced, as entrepreneurs often possess a strong belief in their vision and capabilities. However, when it comes to financial management, overconfidence can be a significant liability. Consider an SMB owner who believes they possess superior financial acumen, even without formal training or experience.

They might forgo seeking professional financial advice, convinced they can handle all financial matters themselves. This self-reliance, fueled by overconfidence, can lead to costly mistakes, such as inadequate budgeting, poor cash flow management, or tax compliance errors. The owner might underestimate the complexity of financial regulations or overestimate their ability to navigate intricate financial instruments, resulting in penalties, lost opportunities, and ultimately, financial setbacks.

Overconfidence also affects investment decisions. SMB owners, confident in their market knowledge and business intuition, might make impulsive investment choices without conducting thorough research or seeking expert opinions. They might invest in a new technology or expand into a new market based on gut feeling rather than rigorous financial analysis. This “shoot from the hip” approach, driven by overconfidence, can lead to misallocation of capital, investments in ventures with limited potential, and ultimately, diminished returns.

Furthermore, overconfident SMB owners are often less receptive to feedback and criticism, hindering their ability to learn from mistakes and adapt their financial strategies. They might dismiss negative performance indicators as temporary blips or external factors, failing to recognize underlying issues in their financial management practices. This resistance to learning and adaptation can perpetuate poor financial habits and impede the SMB’s long-term financial success.

Framing Bias How Information Is Presented Matters

Framing bias highlights the powerful influence of how information is presented on decision-making. The same information, framed differently, can elicit dramatically different responses. For SMB owners, this bias can affect their perception of financial opportunities and risks. Consider a loan offer presented in two different ways.

One lender might frame their interest rate as “a low monthly payment,” emphasizing the affordability aspect. Another lender might present the same loan with “a total interest cost over the loan term,” highlighting the overall expense. Even though both offers might be financially equivalent, the framing can significantly influence the SMB owner’s perception of the loan’s attractiveness. The “low monthly payment” frame might appeal to an owner focused on immediate cash flow, while the “total interest cost” frame might resonate more with an owner concerned about long-term financial burden.

Framing bias also plays a role in pricing decisions. Presenting a price increase as “a small surcharge” rather than “a price hike” can soften customer resistance. Similarly, offering a discount as “a percentage off” versus “a dollar amount off” can influence perceived value, even if the actual discount is the same. For instance, a “10% discount” might seem more appealing than “a $10 discount” on a $100 item, even though both represent the same savings.

In financial reporting, framing can also shape perceptions. Presenting financial results as “exceeding expectations” versus “slightly below target” can influence investor confidence and stakeholder perceptions, even if the actual performance difference is marginal. SMB owners need to be aware of framing effects, both in how they present financial information to others and how they interpret financial information presented to them, to make rational and unbiased financial decisions.

Behavioral biases are not insurmountable obstacles. Recognizing their existence is the first crucial step. By understanding these cognitive quirks, SMB owners can implement strategies to mitigate their influence, fostering more rational and financially sound decision-making.

This involves cultivating a culture of critical self-reflection, seeking diverse perspectives, and implementing structured financial processes that minimize the impact of subjective biases. The journey to financial resilience for SMBs begins with acknowledging the subtle, often unseen, power of behavioral biases.

Cognitive Roadblocks Navigating SMB Financial Strategy

While the fundamental behavioral biases introduce initial hurdles for SMB financial management, the intermediate landscape reveals more intricate cognitive challenges. These biases, deeply embedded in human decision-making, become particularly salient as SMBs grow and face increasingly complex financial scenarios. Consider the scenario of an SMB contemplating a significant technology investment.

The decision is not merely about numbers; it’s a complex interplay of perceived risk, potential reward, and deeply ingrained psychological patterns. These patterns, if left unchecked, can steer even seasoned entrepreneurs towards suboptimal financial paths.

Loss Aversion The Pain Of Losses Looming Larger

Loss aversion, a cornerstone of behavioral economics, posits that the psychological pain of experiencing a loss is significantly greater than the pleasure derived from an equivalent gain. This asymmetry profoundly impacts SMB financial decision-making, often leading to overly conservative strategies or, paradoxically, riskier behaviors aimed at avoiding perceived losses. For instance, an SMB owner might be excessively hesitant to cut losses on a poorly performing investment, clinging to the hope of eventual recovery, even when objective financial analysis suggests divestment is the prudent course of action.

The fear of realizing a loss outweighs the potential benefits of reallocating capital to more promising ventures. This “loss aversion trap” can tie up valuable resources in underperforming assets, hindering the SMB’s overall financial growth and agility.

Loss aversion can paralyze SMBs, preventing them from making necessary but potentially painful financial decisions.

Conversely, loss aversion can paradoxically drive SMBs towards riskier financial behaviors. Consider an SMB facing declining revenues. Driven by the aversion to further losses, the owner might engage in increasingly desperate and high-risk strategies, such as taking on excessive debt or investing in speculative ventures, in a bid to quickly recoup lost ground. This “get-rich-quick” mentality, fueled by loss aversion, often backfires, exacerbating the SMB’s financial woes and potentially leading to insolvency.

The key lies in recognizing the influence of loss aversion and adopting a more balanced perspective, focusing on long-term financial goals and making decisions based on objective risk-reward assessments, rather than being solely driven by the fear of short-term losses. Implementing structured risk management frameworks and seeking external financial counsel can help mitigate the detrimental effects of loss aversion on SMB financial strategy.

Sunk Cost Fallacy Throwing Good Money After Bad

The sunk cost fallacy, a closely related bias to loss aversion, describes the tendency to continue investing in a failing venture or project simply because resources have already been committed, even when further investment is demonstrably irrational. For SMBs, this fallacy can manifest in various financial contexts. Imagine an SMB owner who has invested heavily in a marketing campaign that is yielding poor results.

Despite the lack of positive returns, they might be reluctant to abandon the campaign, reasoning that “we’ve already spent so much money on it.” This line of thinking ignores the fundamental principle of rational decision-making ● future decisions should be based on future costs and benefits, not on past sunk costs that are irretrievable. Continuing to pour resources into a failing campaign, driven by the sunk cost fallacy, represents a misallocation of capital that could be better deployed elsewhere.

The sunk cost fallacy extends beyond marketing. It can influence decisions regarding product development, equipment upgrades, and even personnel. An SMB might persist with a product line that is no longer profitable simply because significant development costs have already been incurred. They might continue using outdated equipment, despite its inefficiency and high maintenance costs, because it represents a “sunk investment.” They might retain underperforming employees, despite their negative impact on productivity, because of the “investment” in training and onboarding.

Overcoming the sunk cost fallacy requires a conscious shift in perspective, focusing on future potential rather than past commitments. SMB owners need to cultivate a willingness to “cut their losses,” to objectively evaluate the viability of ongoing projects and investments, and to reallocate resources to more promising opportunities, even if it means acknowledging past mistakes and writing off sunk costs. This requires discipline, data-driven decision-making, and a commitment to forward-looking financial strategy.

Availability Heuristic What Comes Easily To Mind Shapes Decisions

The availability heuristic is a cognitive shortcut where individuals assess the likelihood of an event based on how readily examples come to mind. Events that are easily recalled, often due to their vividness, recency, or emotional impact, are perceived as more probable than they actually are. In the realm of SMB finances, this heuristic can lead to skewed risk assessments and investment decisions. Consider an SMB owner who recently heard about a local business experiencing a cyberattack and suffering significant financial losses.

This vivid and recent example might make them overestimate the probability of their own business being targeted by cybercriminals, leading to excessive investment in cybersecurity measures, even if the actual risk is relatively low. Conversely, if they have not recently encountered such examples, they might underestimate the risk, leading to inadequate cybersecurity preparedness.

The availability heuristic can lead to overreactions or underreactions to financial risks, based on easily recalled but potentially unrepresentative examples.

The availability heuristic also influences investment decisions. SMB owners might be more inclined to invest in industries or sectors that are frequently featured in news headlines or are currently “trending,” even if those sectors are already overvalued or do not align with the SMB’s core competencies. The readily available information and media attention surrounding these sectors create a perception of high potential and low risk, regardless of the underlying financial fundamentals. Conversely, less publicized but potentially more stable and profitable investment opportunities might be overlooked simply because they are not as readily “available” in the owner’s cognitive landscape.

Mitigating the influence of the availability heuristic requires a conscious effort to seek out objective data and diverse sources of information, rather than relying solely on easily recalled examples or media narratives. Conducting thorough market research, consulting with financial experts, and utilizing data-driven risk assessment tools can help SMB owners make more informed and less biased financial decisions.

Representativeness Heuristic Stereotyping Financial Scenarios

The representativeness heuristic is a cognitive bias where individuals judge the probability of an event based on how similar it is to a mental prototype or stereotype. In SMB finance, this can lead to flawed judgments about investment opportunities and business risks. Imagine an SMB owner evaluating a new franchise opportunity.

If the franchise concept aligns with their preconceived notion of a “successful business” ● perhaps a trendy food concept or a rapidly growing sector ● they might overestimate its probability of success, even if the specific franchise offering has weak financials or a poor track record. They are judging the opportunity based on its representativeness of a successful business stereotype, rather than on a thorough analysis of its individual merits and risks.

This heuristic can also lead to underestimation of risks. If a business opportunity appears “typical” or “conventional,” SMB owners might underestimate the potential for unforeseen challenges or market disruptions. They might assume that “what has worked before will work again,” neglecting to account for evolving market dynamics, competitive pressures, or changing consumer preferences. For example, a retail store owner might underestimate the threat of online retailers, assuming that their traditional brick-and-mortar model, which has been successful in the past, will continue to thrive, despite the growing shift towards e-commerce.

Overcoming the representativeness heuristic requires a shift from intuitive judgments based on stereotypes to analytical assessments based on specific data and evidence. SMB owners need to critically evaluate each financial opportunity and risk on its own merits, avoiding the trap of generalizing based on superficial similarities to preconceived notions of success or failure. This involves conducting rigorous due diligence, seeking expert opinions, and utilizing data-driven decision-making frameworks.

Mental Accounting Treating Money As Non-Fungible

Mental accounting is a cognitive bias where individuals compartmentalize money into separate mental accounts, treating money from different sources or intended for different purposes differently, even though money is inherently fungible. For SMBs, this bias can lead to inefficient allocation of financial resources. Consider an SMB owner who mentally separates “business profits” from “personal savings.” They might be overly cautious with their “business profits,” hoarding them in a low-yielding business account, while simultaneously taking out a high-interest personal loan for home renovations, even though using the “business profits” to fund the renovations would be financially more rational. This compartmentalization prevents them from seeing their finances holistically and making optimal resource allocation decisions.

Mental accounting can lead to illogical financial decisions, as SMB owners fail to recognize the fungibility of money across different mental categories.

Mental accounting also affects spending decisions. SMB owners might be more willing to spend “windfall gains,” such as unexpected tax refunds or one-time bonuses, on discretionary expenses, while being more frugal with “hard-earned” revenue, even if both sources of funds are equally valuable to the business. This can lead to inconsistent spending patterns and suboptimal investment decisions. For example, an SMB might splurge on unnecessary office upgrades after receiving a tax refund, while neglecting to invest in essential equipment maintenance or employee training.

Overcoming mental accounting requires adopting a unified view of finances, recognizing that money is fungible regardless of its source or intended purpose. SMB owners need to consolidate their financial accounts, track all income and expenses comprehensively, and make resource allocation decisions based on overall financial priorities and strategic objectives, rather than being influenced by arbitrary mental categories. Developing a comprehensive financial plan and utilizing budgeting tools can help promote a more rational and holistic approach to SMB financial management.

Navigating the intermediate complexities of behavioral biases requires a proactive and structured approach. SMBs need to move beyond simply acknowledging these biases to actively implementing strategies to mitigate their impact. This involves fostering a culture of financial awareness, promoting data-driven decision-making, and seeking external expertise to provide objective perspectives. By consciously addressing these cognitive roadblocks, SMBs can unlock their financial potential and build more resilient and prosperous businesses.

Strategic Defenses Against Cognitive Pitfalls In SMB Finance

At the advanced level, the influence of behavioral biases on SMB finances transcends individual decisions, permeating strategic frameworks Meaning ● Strategic Frameworks in the context of SMB Growth, Automation, and Implementation constitute structured, repeatable methodologies designed to achieve specific business goals; for a small to medium business, this often translates into clearly defined roadmaps guiding resource allocation and project execution. and organizational culture. These biases, often operating subtly and unconsciously, can distort strategic planning, hinder automation initiatives, and impede effective implementation of growth strategies. Consider an SMB embarking on a significant automation project.

The decision is not solely a technical or operational one; it is deeply intertwined with organizational psychology, risk perception, and deeply entrenched cognitive patterns. These patterns, if unaddressed, can sabotage even the most well-intentioned strategic initiatives.

Status Quo Bias Resistance To Change And Innovation

Status quo bias, a powerful cognitive inertia, describes the preference for maintaining the current state of affairs, even when change offers potential benefits. In SMB finance, this bias can manifest as resistance to adopting new technologies, automating processes, or implementing innovative financial strategies. SMB owners, particularly those with established businesses, might be comfortable with their existing financial systems and processes, even if those systems are inefficient, outdated, or hindering growth.

The perceived effort and uncertainty associated with change outweigh the potential benefits of modernization. This resistance to change, fueled by status quo bias, can stifle innovation, reduce competitiveness, and ultimately limit the SMB’s long-term financial prospects.

Status quo bias can cripple SMBs by preventing them from adapting to changing market conditions and embracing necessary innovation.

This bias is particularly relevant in the context of automation. SMB owners might be hesitant to invest in automation technologies, fearing disruption to existing workflows, employee resistance, or the perceived complexity of implementation. They might cling to manual processes, even when automation offers significant cost savings, efficiency gains, and improved accuracy. This reluctance to automate, driven by status quo bias, can put SMBs at a disadvantage compared to more agile and technologically advanced competitors.

Overcoming status quo bias Meaning ● Status Quo Bias, within the SMB arena, represents an irrational preference for the current state of affairs when exploring growth initiatives, automation projects, or new system implementations. requires a proactive approach to change management, emphasizing the long-term benefits of innovation, addressing employee concerns, and demonstrating the ease of implementation of new technologies and strategies. Cultivating a culture of continuous improvement and embracing a growth mindset can help SMBs overcome this cognitive inertia and unlock the potential of innovation and automation.

Bandwagon Effect Following The Crowd In Financial Decisions

The bandwagon effect, a well-documented social phenomenon, describes the tendency to adopt beliefs, behaviors, or trends simply because they are popular or widely adopted by others. In SMB finance, this bias can lead to herd behavior in investment decisions and strategic choices. SMB owners might be swayed by popular investment trends or industry fads, investing in assets or pursuing strategies simply because “everyone else is doing it,” without conducting independent due diligence or assessing the suitability of these choices for their own business. This herd mentality can lead to investment bubbles, misallocation of resources, and ultimately, financial losses when the bandwagon effect inevitably reverses.

This bias is particularly relevant in rapidly evolving markets or during periods of economic uncertainty. SMB owners might be tempted to follow the investment strategies of larger corporations or industry leaders, assuming that these “experts” possess superior knowledge and foresight. However, what is suitable for a large corporation might not be appropriate for an SMB with different risk profiles, resources, and strategic objectives. Blindly following the crowd, driven by the bandwagon effect, can expose SMBs to unnecessary risks and divert them from pursuing strategies that are truly aligned with their unique circumstances and goals.

Mitigating the bandwagon effect requires cultivating independent thinking, conducting thorough research and analysis, and making financial decisions based on objective data and personalized strategic assessments, rather than being swayed by popular opinion or herd mentality. Seeking advice from independent financial advisors and developing a contrarian investment mindset can help SMBs avoid the pitfalls of bandwagon effects.

Hindsight Bias The Illusion Of Predictability

Hindsight bias, often referred to as the “I-knew-it-all-along” effect, is the tendency to believe, after an event has occurred, that one would have predicted or expected the outcome, even if there was no objective basis for such prediction beforehand. In SMB finance, this bias can distort performance evaluations, impede learning from mistakes, and lead to overconfidence in future predictions. After a successful financial outcome, SMB owners might retrospectively overestimate their ability to have foreseen the success, attributing it to their superior foresight or skill, even if luck or external factors played a significant role. This inflated sense of predictability can lead to overconfidence in future financial forecasts and strategic planning, resulting in unrealistic expectations and potentially risky decisions.

Hindsight bias can create a false sense of security and impede learning, as SMB owners overestimate their predictive abilities based on past outcomes.

Conversely, after a negative financial outcome, SMB owners might retrospectively underestimate their ability to have foreseen the failure, blaming external factors or unforeseen circumstances, even if there were warning signs that were ignored or downplayed at the time. This distorted perception of past events can hinder learning from mistakes and prevent the implementation of necessary corrective actions. If SMB owners believe that negative outcomes were unpredictable and unavoidable, they are less likely to critically analyze their decision-making processes and identify areas for improvement.

Overcoming hindsight bias requires a conscious effort to objectively evaluate past decisions, focusing on the information available at the time the decision was made, rather than being influenced by subsequent outcomes. Implementing structured post-mortem analyses of financial successes and failures, documenting decision-making processes, and seeking feedback from external advisors can help mitigate the distorting effects of hindsight bias and promote more accurate performance evaluations and learning from experience.

Confirmation Trap Reinforcing Existing Strategic Frameworks

The confirmation trap, an extension of confirmation bias, describes the tendency to actively seek out and interpret information that confirms existing strategic frameworks or business models, while dismissing or downplaying contradictory evidence, even when those frameworks are becoming obsolete or ineffective. For SMBs, particularly those with established business models, this trap can lead to strategic inertia and a failure to adapt to changing market dynamics. SMB owners might become overly attached to their existing strategies, selectively focusing on data points that support their continued validity, while ignoring or rationalizing away evidence of declining performance or emerging competitive threats. This strategic myopia, fueled by the confirmation trap, can prevent SMBs from recognizing the need for strategic pivots or fundamental business model adjustments, ultimately leading to stagnation or decline.

This trap is particularly dangerous in rapidly disrupted industries or during periods of technological upheaval. SMB owners might cling to outdated business models, assuming that “what has worked in the past will continue to work in the future,” even when disruptive technologies or changing consumer preferences are rendering those models obsolete. They might selectively focus on anecdotal success stories of businesses clinging to traditional approaches, while ignoring the broader trend towards disruption and innovation.

Escaping the confirmation trap requires a proactive approach to strategic reassessment, regularly challenging existing assumptions, actively seeking out dissenting opinions, and embracing a culture of strategic agility and adaptability. Conducting scenario planning exercises, engaging in competitive intelligence gathering, and fostering open dialogue about strategic alternatives can help SMBs break free from the confirmation trap and proactively adapt to evolving market landscapes.

Automation Bias Over-Reliance On Automated Systems

Automation bias describes the tendency to over-rely on automated systems and algorithms, even when those systems are demonstrably flawed or when human oversight Meaning ● Human Oversight, in the context of SMB automation and growth, constitutes the strategic integration of human judgment and intervention into automated systems and processes. is necessary. As SMBs increasingly adopt automation technologies in their financial operations, this bias becomes a critical concern. SMB owners and employees might develop an unwarranted trust in automated financial reporting systems, budgeting tools, or algorithmic trading platforms, assuming that these systems are inherently accurate and infallible.

This over-reliance can lead to a reduction in critical thinking, a neglect of human oversight, and ultimately, costly errors or missed opportunities. For example, an SMB might blindly trust an automated financial forecasting system, failing to critically evaluate its underlying assumptions or data inputs, leading to flawed strategic plans based on inaccurate projections.

Automation bias presents a paradoxical risk in SMB automation efforts, leading to over-reliance and diminished human oversight of critical financial processes.

This bias is particularly problematic in complex or dynamic financial environments where automated systems might struggle to account for unforeseen events, qualitative factors, or nuanced contextual information. Relying solely on automated systems without human oversight can create “black box” financial processes, where SMB owners and employees lack a clear understanding of how decisions are being made or how results are being generated. Mitigating automation bias Meaning ● Over-reliance on automated systems, neglecting human oversight, impacting SMB decisions. requires a balanced approach to technology adoption, emphasizing the importance of human-in-the-loop systems, where automated tools augment, rather than replace, human judgment and expertise.

Implementing robust validation and verification processes for automated financial outputs, providing ongoing training to employees on critical evaluation of automated systems, and maintaining a culture of healthy skepticism towards technology can help SMBs harness the benefits of automation while mitigating the risks of automation bias. This involves recognizing that automation is a tool to enhance human capabilities, not a substitute for human intelligence and oversight.

Strategic defenses against cognitive pitfalls in SMB finance Meaning ● SMB Finance, in the context of Small and Medium-sized Businesses, represents the comprehensive management of financial resources, planning, and strategy necessary for business growth, implementing automation technologies, and executing strategic business initiatives. require a holistic and proactive approach. It’s about embedding behavioral awareness into the organizational DNA, fostering a culture of critical thinking, and implementing robust processes that minimize the impact of biases at every level of strategic decision-making. This includes promoting financial literacy across the organization, encouraging diverse perspectives, and establishing clear accountability for financial outcomes. By proactively addressing these advanced cognitive challenges, SMBs can build resilient financial strategies, navigate complex market dynamics, and achieve sustainable growth in an increasingly uncertain business environment.

References

- Kahneman, Daniel. Thinking, Fast and Slow. Farrar, Straus and Giroux, 2011.

- Tversky, Amos, and Daniel Kahneman. “Judgment under Uncertainty ● Heuristics and Biases.” Science, vol. 185, no. 4157, 27 Sept. 1974, pp. 1124-31.

- Ariely, Dan. Predictably Irrational, Revised and Expanded Edition ● The Hidden Forces That Shape Our Decisions. Harper Perennial, 2009.

- Thaler, Richard H., and Cass R. Sunstein. Nudge ● Improving Decisions About Health, Wealth, and Happiness. Penguin Books, 2009.

- Montier, James. Behavioural Investing ● A Practitioner’s Guide to Applying Behavioural Finance. John Wiley & Sons, 2007.

Reflection

Perhaps the most profound bias affecting SMB finances is not listed in any textbook ● the bias of relentless action. SMB owners, by their very nature, are doers. This bias towards action, while often a strength, can become a weakness when it eclipses the necessity for strategic reflection and unbiased analysis. In the relentless pursuit of growth and survival, SMB owners might inadvertently favor quick, decisive actions over slower, more considered evaluations, falling prey to the very biases we’ve discussed, amplified by the pressure to “just get it done.” True financial mastery for SMBs might then lie not just in understanding cognitive biases, but in cultivating the discipline to occasionally resist the urge to act, to pause, reflect, and ensure decisions are driven by strategy, not just the ingrained bias for action itself.

Behavioral biases significantly impact SMB finances, skewing decisions from basic budgeting to advanced strategic planning, necessitating awareness and mitigation.

Explore

What Financial Biases Most Harm SMB Growth?

How Can SMBs Mitigate Cognitive Biases In Financial Planning?

To What Extent Does Automation Exacerbate Or Alleviate Behavioral Biases In SMB Finance?