Fundamentals

Consider this ● a leaky bucket, no matter how vigorously you pour water into it, will never fill if the holes aren’t plugged. Small businesses often operate under the illusion that relentless customer acquisition Meaning ● Gaining new customers strategically and ethically for sustainable SMB growth. is the sole path to prosperity, overlooking the silent drain of customer attrition. This oversight isn’t merely a missed opportunity; it’s a fundamental miscalculation of long-term value.

For a Main Street bakery or a burgeoning tech startup, the customers they keep are often more valuable than the new ones they chase. This concept, customer retention, directly influences how a small to medium-sized business (SMB) is perceived, operated, and ultimately, valued.

Understanding Customer Retention Basics

Customer retention, at its core, represents a business’s ability to keep its customers over a period. It’s the opposite of customer churn, which measures how many customers a business loses. For SMBs, understanding retention is not some abstract corporate exercise; it’s about survival and growth. Imagine a local coffee shop.

If they focus solely on attracting new customers with flashy promotions but neglect the regulars who form the backbone of their daily sales, they are essentially running on a treadmill, expending energy without moving forward effectively. Retention is about building relationships, fostering loyalty, and ensuring customers see continued value in what your SMB offers.

Why Retention Matters for SMBs

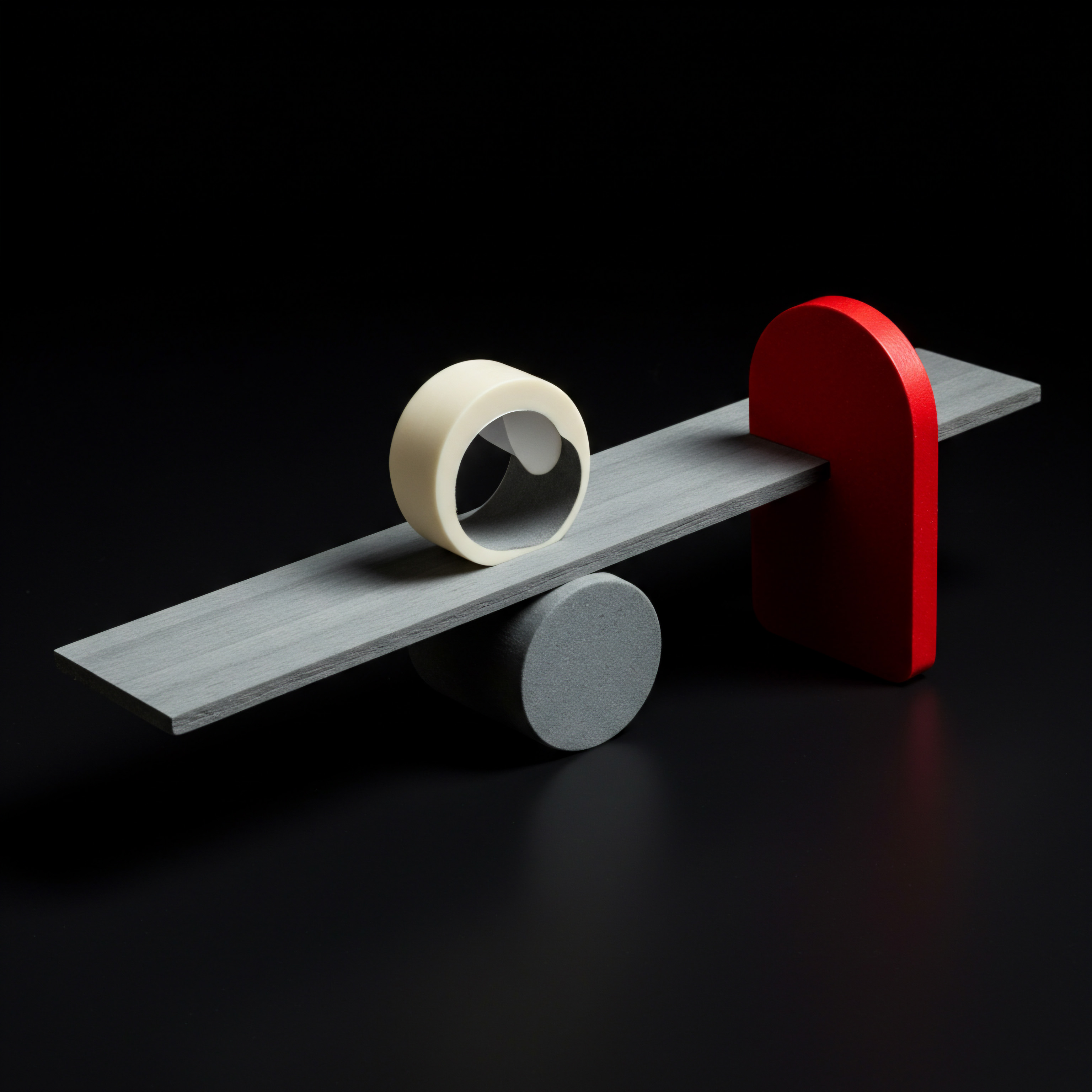

Acquiring a new customer is demonstrably more expensive than retaining an existing one. Industry figures often cite costs being several times higher ● some estimations suggest five to twenty-five times more expensive. This isn’t just about marketing budgets; it includes sales efforts, onboarding costs, and the time invested in converting a prospect into a paying customer.

For SMBs operating with tighter margins and resource constraints, this cost difference is significant. Focusing on retention allows SMBs to optimize their spending, directing resources towards nurturing existing relationships rather than constantly refilling the customer bucket.

Retained customers are often more profitable. They tend to spend more over time, make repeat purchases, and are less price-sensitive. Think about a subscription box service. A customer who stays subscribed for a year is far more valuable than someone who signs up for a single month and then cancels.

Loyal customers understand the value proposition, trust the brand, and are willing to invest further. This predictable revenue stream from retained customers is a bedrock for SMB financial stability and growth.

Customer retention is not merely a tactic; it’s a strategic imperative that underpins the long-term financial health and valuation of any SMB.

Direct Impact on SMB Valuation

SMB valuation is the process of determining the economic worth of a small to medium-sized business. It’s a critical metric for various reasons, including securing loans, attracting investors, or planning for a sale or acquisition. Customer retention Meaning ● Customer Retention: Nurturing lasting customer relationships for sustained SMB growth and advocacy. figures prominently in this valuation. A high customer retention rate Meaning ● Customer Retention Rate (CRR) quantifies an SMB's ability to keep customers engaged over a given period, a vital metric for sustainable business expansion. signals a healthy, sustainable business model to potential investors and buyers.

It indicates that the SMB has built a solid customer base that is likely to generate consistent revenue in the future. Conversely, a low retention rate Meaning ● Retention Rate, in the context of Small and Medium-sized Businesses, represents the percentage of customers a business retains over a specific period. raises red flags, suggesting potential problems with product-market fit, customer service, or overall business strategy.

Retention as a Predictor of Future Revenue

Valuation is inherently forward-looking. Investors and buyers are not just interested in past performance; they are assessing future potential. Customer retention data provides a reliable indicator of future revenue streams. If an SMB consistently retains a large percentage of its customers, it can reasonably project stable or increasing revenue.

This predictability is highly valued because it reduces risk. A business with strong retention is less vulnerable to market fluctuations or competitive pressures. Its revenue is anchored by a loyal customer base, providing a buffer against uncertainty.

Building Retention into SMB Strategy

For SMBs, improving customer retention is not about implementing complex, expensive programs. It often starts with simple, customer-centric practices. Providing excellent customer service Meaning ● Customer service, within the context of SMB growth, involves providing assistance and support to customers before, during, and after a purchase, a vital function for business survival. is paramount. This means being responsive, helpful, and going the extra mile to resolve issues.

Personalization also plays a crucial role. Understanding customer preferences and tailoring interactions accordingly can significantly enhance loyalty. This could be as simple as remembering a regular customer’s usual order or sending personalized birthday greetings.

Creating a loyalty program can be an effective tool. It rewards repeat customers, incentivizing continued business. These programs do not need to be elaborate; even a simple punch card system at a local cafe can encourage repeat visits. Regular communication is also vital.

Staying in touch with customers through newsletters, emails, or social media keeps the SMB top-of-mind and provides opportunities to offer value beyond just products or services. Seeking and acting on customer feedback is equally important. It shows customers that their opinions are valued and provides valuable insights into areas for improvement.

Retention Metrics for SMBs

To effectively manage customer retention, SMBs need to track relevant metrics. The customer retention rate itself is a primary metric, calculated as the percentage of customers retained over a specific period. Churn rate, the inverse of retention rate, is also important to monitor. Customer lifetime value Meaning ● Customer Lifetime Value (CLTV) for SMBs is the projected net profit from a customer relationship, guiding strategic decisions for sustainable growth. (CLTV) is another crucial metric.

It estimates the total revenue a customer will generate throughout their relationship with the business. By understanding CLTV, SMBs can make informed decisions about customer acquisition costs and retention investments.

Customer satisfaction (CSAT) and Net Promoter Score Meaning ● Net Promoter Score (NPS) quantifies customer loyalty, directly influencing SMB revenue and growth. (NPS) are valuable qualitative metrics. CSAT measures how satisfied customers are with specific interactions or aspects of the business. NPS gauges customer loyalty Meaning ● Customer loyalty for SMBs is the ongoing commitment of customers to repeatedly choose your business, fostering growth and stability. by asking how likely they are to recommend the business to others. These metrics provide insights into customer sentiment and can highlight areas where the SMB is excelling or falling short in customer experience.

Consider these key metrics in action:

| Metric Customer Retention Rate (CRR) |

| Description Percentage of customers retained over a period. |

| Importance for SMB Valuation Directly reflects business health and future revenue stability. Higher CRR boosts valuation. |

| Metric Customer Churn Rate |

| Description Percentage of customers lost over a period. |

| Importance for SMB Valuation Indicates potential problems. High churn rate negatively impacts valuation. |

| Metric Customer Lifetime Value (CLTV) |

| Description Total revenue a customer generates over their relationship. |

| Importance for SMB Valuation Shows long-term profitability of customer relationships. Higher CLTV increases valuation. |

| Metric Customer Satisfaction (CSAT) |

| Description Measures customer satisfaction with interactions. |

| Importance for SMB Valuation Reflects customer experience quality. High CSAT contributes to better retention and valuation. |

| Metric Net Promoter Score (NPS) |

| Description Measures customer loyalty and likelihood to recommend. |

| Importance for SMB Valuation Indicates brand advocacy and future growth potential. Positive NPS enhances valuation. |

Automation and Retention for SMBs

Automation can play a significant role in enhancing customer retention for SMBs, even with limited resources. Customer Relationship Management (CRM) systems, even basic ones, can automate customer data Meaning ● Customer Data, in the sphere of SMB growth, automation, and implementation, represents the total collection of information pertaining to a business's customers; it is gathered, structured, and leveraged to gain deeper insights into customer behavior, preferences, and needs to inform strategic business decisions. management, personalize communications, and track interactions. Email marketing automation Meaning ● Marketing Automation for SMBs: Strategically automating marketing tasks to enhance efficiency, personalize customer experiences, and drive sustainable business growth. can send targeted messages, reminders, and offers to keep customers engaged.

Chatbots can provide instant customer support, addressing queries and resolving issues promptly, improving customer satisfaction. Social media automation can help maintain consistent communication and engagement with customers across different platforms.

Implementing automation does not require a complete overhaul of SMB operations. Starting with simple tools and processes can yield significant improvements in efficiency and customer experience. For instance, automated follow-up emails after a purchase or service interaction can proactively address potential issues and show customers that their business is valued. Automated feedback surveys can collect valuable data on customer satisfaction Meaning ● Customer Satisfaction: Ensuring customer delight by consistently meeting and exceeding expectations, fostering loyalty and advocacy. and identify areas for improvement.

The key is to use automation strategically to enhance human interaction, not replace it entirely. Customers still value personal connection, especially in the SMB context.

Customer retention is not some peripheral concern for SMBs; it is deeply interwoven with their long-term valuation. By understanding the fundamentals of retention, tracking key metrics, and strategically implementing retention-focused strategies, including smart automation, SMBs can build stronger, more valuable businesses. It’s about shifting the focus from the constant chase for new customers to nurturing the relationships already established. This shift in perspective can be transformative, turning a leaky bucket into a wellspring of sustainable growth and increased valuation.

Intermediate

The adage that it costs less to keep a customer than to acquire a new one, while frequently cited, often overshadows a more profound truth ● customer retention is not merely a cost-saving measure; it’s a potent driver of long-term SMB valuation, influencing investor confidence and market positioning far beyond immediate revenue gains. For the savvy SMB operator, retention transcends simple loyalty programs; it becomes a strategic lever, impacting everything from operational efficiency to exit strategy.

Deep Dive into Retention Economics

The economic impact of customer retention extends beyond the oft-quoted acquisition cost differential. Consider the concept of customer lifetime profitability (CLP). This metric, a refinement of customer lifetime value, factors in not just revenue but also the costs associated with serving a customer over their entire relationship with the SMB. Retained customers, particularly those who evolve into loyal advocates, often exhibit a significantly higher CLP.

They require less marketing expenditure, generate word-of-mouth referrals, and are more receptive to upselling and cross-selling opportunities. This translates to higher profit margins and a more robust bottom line.

Furthermore, a strong customer retention rate acts as a buffer against economic downturns and market volatility. SMBs with a loyal customer base are less susceptible to fluctuations in new customer acquisition, providing a degree of revenue stability that is highly attractive to investors and lenders. This resilience is not merely anecdotal; studies have shown a direct correlation between customer retention and business longevity, particularly in competitive markets. For SMBs seeking growth capital or preparing for future expansion, demonstrating a solid retention track record is paramount.

Retention’s Influence on Valuation Multiples

SMB valuation often employs earnings multiples, such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples, to determine business worth. These multiples are not static; they are influenced by various factors, including industry, growth rate, and, critically, customer retention. SMBs with demonstrably high customer retention rates often command higher valuation multiples.

This is because retention is perceived as a proxy for business quality, sustainability, and reduced risk. Investors are willing to pay a premium for businesses that exhibit strong customer loyalty, as it signals a lower likelihood of future revenue erosion and a higher probability of sustained profitability.

Consider two hypothetical SMBs in the same industry with similar revenue and profitability. SMB A has a customer retention rate of 90%, while SMB B struggles at 70%. Despite comparable current financials, SMB A is likely to be valued at a significantly higher multiple.

The market recognizes that SMB A’s revenue stream is more secure and predictable due to its superior customer retention. This translates directly into a higher valuation, reflecting the long-term value embedded in its customer relationships.

Superior customer retention isn’t just good business practice; it’s a catalyst for enhanced valuation multiples, directly impacting the financial attractiveness of an SMB.

Strategic Retention Frameworks for SMBs

Moving beyond basic customer service, SMBs can adopt more strategic retention frameworks. A customer journey mapping exercise can be invaluable. This involves visualizing the entire customer experience, from initial awareness to post-purchase engagement.

By identifying pain points and opportunities for improvement at each stage of the journey, SMBs can proactively address issues that contribute to customer churn. This proactive approach, focused on optimizing the entire customer experience, is far more effective than reactive measures taken after customers have already become dissatisfied.

Segmentation is another crucial element of a strategic retention framework. Not all customers are created equal. Identifying high-value customer segments and tailoring retention efforts to their specific needs and preferences can yield significant returns.

This might involve personalized communication, exclusive offers, or enhanced service levels for key customer groups. By focusing resources on retaining the most profitable customer segments, SMBs can maximize the impact of their retention initiatives.

Leveraging Technology for Advanced Retention

Technology offers SMBs sophisticated tools to enhance customer retention beyond basic CRM functionalities. Marketing automation platforms can orchestrate complex, multi-channel customer engagement Meaning ● Customer Engagement is the ongoing, value-driven interaction between an SMB and its customers, fostering loyalty and driving sustainable growth. campaigns, delivering personalized messages at scale. Advanced analytics platforms can analyze customer data to identify churn predictors, enabling proactive intervention before customers defect. Customer feedback management systems can collect and analyze customer sentiment across various channels, providing real-time insights into customer satisfaction and areas for improvement.

Artificial intelligence (AI) and machine learning Meaning ● Machine Learning (ML), in the context of Small and Medium-sized Businesses (SMBs), represents a suite of algorithms that enable computer systems to learn from data without explicit programming, driving automation and enhancing decision-making. (ML) are increasingly being deployed for customer retention. AI-powered chatbots can provide personalized support and resolve issues efficiently. ML algorithms can predict customer churn Meaning ● Customer Churn, also known as attrition, represents the proportion of customers that cease doing business with a company over a specified period. with greater accuracy, allowing for targeted retention efforts.

Personalization engines can deliver highly customized product recommendations and offers, enhancing customer engagement and loyalty. While these technologies were once the domain of large corporations, they are becoming increasingly accessible and affordable for SMBs, offering powerful tools to elevate customer retention strategies.

Consider the impact of predictive churn analysis:

| Component Data Collection |

| Description Gathering customer data ● purchase history, demographics, website activity, support interactions. |

| Retention Benefit Provides the raw material for analysis and churn prediction. |

| Component Machine Learning Algorithms |

| Description Using algorithms to identify patterns and predict which customers are likely to churn. |

| Retention Benefit Enables accurate identification of at-risk customers. |

| Component Churn Prediction Score |

| Description Assigning a score to each customer indicating their churn probability. |

| Retention Benefit Prioritizes retention efforts on high-risk customers. |

| Component Proactive Intervention |

| Description Implementing targeted actions for at-risk customers ● personalized offers, outreach, improved service. |

| Retention Benefit Reduces churn by addressing issues before customers leave. |

Retention Implementation and Automation

Implementing advanced retention strategies requires a structured approach. Begin with a comprehensive customer data audit to understand the available data and identify gaps. Select appropriate technology solutions based on SMB needs and budget, starting with scalable and integrable systems. Develop clear retention processes and workflows, defining roles and responsibilities.

Train staff on new technologies and retention strategies, emphasizing a customer-centric culture. Continuously monitor retention metrics, analyze results, and iterate on strategies to optimize performance. Automation should be implemented strategically to streamline processes, personalize interactions, and free up human resources for more complex customer engagement.

Automation in retention implementation is not about replacing human interaction but augmenting it. Automated email sequences Meaning ● Automated Email Sequences represent a series of pre-written emails automatically sent to targeted recipients based on specific triggers or schedules, directly impacting lead nurturing and customer engagement for SMBs. can nurture leads and onboard new customers efficiently. Automated feedback requests can gather customer insights at scale. Automated personalized recommendations can enhance customer experience Meaning ● Customer Experience for SMBs: Holistic, subjective customer perception across all interactions, driving loyalty and growth. and drive repeat purchases.

However, critical customer interactions, such as resolving complex issues or building strong relationships with key accounts, still require a human touch. The optimal approach is a hybrid model, leveraging automation for efficiency and scalability while preserving human interaction for personalization and relationship building.

Customer retention, viewed through an intermediate lens, is not simply about keeping customers satisfied; it’s about strategically managing customer relationships Meaning ● Customer Relationships, within the framework of SMB expansion, automation processes, and strategic execution, defines the methodologies and technologies SMBs use to manage and analyze customer interactions throughout the customer lifecycle. to maximize long-term value and enhance SMB valuation. By adopting advanced frameworks, leveraging technology intelligently, and implementing structured processes, SMBs can transform retention from a reactive function into a proactive driver of sustainable growth and increased business worth. This strategic approach to retention is what differentiates high-performing SMBs and positions them for long-term success and enhanced valuation.

Advanced

Beyond the conventional metrics of customer retention rate and customer lifetime value lies a more intricate relationship between sustained customer loyalty and the long-term valuation of small to medium-sized businesses. This relationship, when dissected through the lens of advanced business analytics and strategic financial modeling, reveals that customer retention is not merely a contributing factor to SMB valuation; it is a foundational determinant, shaping investor perception, influencing capital access, and ultimately, defining the trajectory of business growth and exit potential.

The Dynamic Interplay of Retention and Valuation

The impact of customer retention on SMB valuation Meaning ● SMB Valuation is determining a private business's economic worth, considering financials, operations, market, and future potential. transcends linear correlations. It operates within a dynamic system of interconnected variables, influencing not only revenue predictability but also operational efficiency, brand equity, and perceived risk. Advanced valuation methodologies, such as discounted cash flow (DCF) analysis, explicitly incorporate future revenue projections, and customer retention data serves as a critical input for these projections. A high retention rate translates to more stable and predictable future cash flows, which, in turn, increases the present value of the business, a core component of DCF valuation.

Furthermore, customer retention indirectly impacts valuation through its influence on operational metrics. Businesses with strong retention often exhibit lower customer acquisition costs (CAC), higher marketing ROI, and streamlined customer service operations. These efficiencies contribute to improved profitability and stronger financial performance, further enhancing valuation.

The interplay is synergistic ● retention drives efficiency, efficiency boosts profitability, and profitability elevates valuation. This interconnectedness underscores the strategic importance of customer retention as a holistic value driver, not merely a siloed metric.

Retention as a Signal of Business Health and Resilience

In the eyes of sophisticated investors and acquirers, customer retention serves as a potent signal of underlying business health and resilience. A high retention rate is interpreted as evidence of strong product-market fit, effective customer service, and a robust value proposition. It suggests that the SMB has cultivated enduring customer relationships, built on trust and mutual benefit, rather than relying on transient transactional interactions. This perception of stability and long-term viability is invaluable in attracting investment and securing favorable acquisition terms.

Conversely, a low customer retention rate, even amidst impressive short-term revenue growth, can raise significant concerns. It may indicate unsustainable customer acquisition practices, a flawed business model, or underlying customer dissatisfaction. Investors are wary of businesses that hemorrhage customers, regardless of initial growth spurts, as this suggests a lack of long-term sustainability and a higher risk of future decline. Customer retention, therefore, functions as a litmus test, revealing the true health and long-term prospects of an SMB, influencing valuation far more profoundly than superficial financial metrics alone.

Customer retention operates as a sophisticated signal, conveying business health and resilience to investors, profoundly shaping valuation perceptions and investment decisions.

Advanced Retention Modeling and Valuation Integration

To fully leverage the valuation impact of customer retention, SMBs should integrate advanced retention modeling into their financial planning and valuation processes. Cohort analysis, a powerful technique, allows for the tracking of customer retention rates over time for specific customer groups acquired in the same period. This provides granular insights into retention trends, identifying patterns and potential issues not visible in aggregate retention metrics. Predictive modeling, utilizing machine learning algorithms, can forecast future retention rates based on historical data and various influencing factors, enabling more accurate long-term revenue projections for valuation purposes.

Furthermore, scenario planning, incorporating different retention rate scenarios, can provide a range of valuation outcomes, highlighting the sensitivity of valuation to changes in customer loyalty. Stress-testing valuation models under various retention scenarios allows SMBs to quantify the potential impact of retention improvement initiatives and prioritize investments accordingly. This sophisticated approach, integrating advanced retention analytics into valuation modeling, transforms retention from a reactive metric into a proactive strategic lever for value creation.

Automation Ecosystems for Hyper-Personalized Retention

Advanced automation ecosystems, extending beyond basic CRM and marketing automation, are crucial for achieving hyper-personalized customer retention at scale. These ecosystems leverage data from diverse sources ● CRM, marketing platforms, customer service interactions, social media, IoT devices ● to create a 360-degree view of each customer. AI-powered personalization engines analyze this data to deliver highly tailored experiences across all touchpoints, anticipating customer needs and proactively addressing potential pain points. Real-time personalization, adapting interactions based on immediate customer behavior and context, further enhances engagement and loyalty.

Intelligent automation, incorporating machine learning and natural language processing Meaning ● Natural Language Processing (NLP), in the sphere of SMB growth, focuses on automating and streamlining communications to boost efficiency. (NLP), enables proactive customer service, resolving issues before they escalate and fostering stronger customer relationships. Predictive analytics, integrated into automation workflows, triggers personalized retention interventions for at-risk customers, maximizing the effectiveness of retention efforts. This advanced automation ecosystem, moving beyond rule-based systems to intelligent, adaptive personalization, represents the future of customer retention, driving not only improved loyalty but also significant gains in long-term SMB valuation.

Consider the architecture of a hyper-personalized retention ecosystem:

| Layer Data Integration Layer |

| Technology/Functionality CRM, Marketing Automation, Customer Service Platforms, Social Media APIs, IoT Data Streams |

| Valuation Impact Unified customer view, comprehensive data for personalization and analysis. |

| Layer AI-Powered Personalization Engine |

| Technology/Functionality Machine Learning Algorithms, Predictive Analytics, Natural Language Processing (NLP) |

| Valuation Impact Hyper-personalized experiences, proactive issue resolution, churn prediction. |

| Layer Real-Time Interaction Layer |

| Technology/Functionality Dynamic Content Delivery, Contextual Marketing, Real-Time Customer Service Chatbots |

| Valuation Impact Enhanced customer engagement, immediate response to needs, improved satisfaction. |

| Layer Automation Workflow Layer |

| Technology/Functionality Automated Email Sequences, Triggered Campaigns, Personalized Recommendation Engines |

| Valuation Impact Scalable personalization, efficient retention interventions, optimized resource allocation. |

Implementing a Valuation-Centric Retention Strategy

Implementing a valuation-centric retention strategy requires a fundamental shift in organizational mindset, moving beyond a transactional customer focus to a relationship-driven approach. This involves aligning retention goals with overall business valuation objectives, making retention a key performance indicator (KPI) at the executive level. Investing in advanced retention technologies and analytics capabilities is crucial, viewing these as strategic investments rather than mere operational expenses. Building a customer-centric culture, empowering employees to prioritize customer loyalty, and fostering a data-driven approach to retention management are essential organizational transformations.

Furthermore, communicating the value of customer retention to investors and stakeholders is paramount. Articulating the link between retention and valuation, showcasing retention metrics and projections, and demonstrating a commitment to long-term customer relationships are critical for enhancing investor confidence and securing favorable valuation outcomes. This proactive communication, highlighting the strategic importance of customer retention, positions the SMB as a high-quality, sustainable investment, maximizing its long-term valuation potential.

Customer retention, in its advanced interpretation, is not merely a function of customer service or marketing tactics; it is a strategic imperative that directly and profoundly shapes the long-term valuation of SMBs. By embracing advanced analytics, leveraging sophisticated automation ecosystems, and adopting a valuation-centric approach to retention management, SMBs can unlock the full potential of customer loyalty as a powerful driver of business value, attracting investment, enhancing market position, and ultimately, maximizing their long-term financial success and exit opportunities.

References

- Reichheld, Frederick F., and Phil Schefter. “Zero defections ● quality comes to services.” Harvard Business Review 78.1 (2000) ● 105-111.

- Anderson, Eugene W., Claes Fornell, and Roland T. Rust. “Customer satisfaction, productivity, and profitability ● Differences between goods and services.” Marketing science 16.2 (1997) ● 129-148.

- Gupta, Sunil, and Donald R. Lehmann. “Customers as assets.” Journal of Interactive Marketing 17.1 (2003) ● 9-24.

Reflection

Perhaps the relentless pursuit of new customer acquisition, often lauded as the lifeblood of SMB growth, inadvertently blinds businesses to the quieter, yet far more profound, power of customer retention. It’s akin to chasing fleeting mirages in a desert while overlooking the oasis at your doorstep. The real valuation narrative for SMBs may not reside in the flash of new customer numbers, but in the enduring strength of customer relationships cultivated over time. This quiet strength, often underestimated, forms the bedrock of sustainable value, a truth that challenges the conventional growth-at-all-costs mantra prevalent in the SMB landscape.

Customer retention profoundly impacts SMB valuation by ensuring revenue stability, boosting profitability, and signaling business health to investors.

Explore

What Business Metrics Reflect Customer Retention?

How Can Automation Enhance Customer Retention Strategies?

Why Does Customer Retention Drive Long Term SMB Growth?